Introduction

Definition of Cryptocurrency Mining

Cryptocurrency mining is a crucial process that allows the generation of new coins and the verification of transactions within a given cryptocurrency network. In simple terms, it involves the use of computational power to solve complex mathematical problems, which in turn helps maintain the integrity and security of the blockchain. Miners compete to be the first to solve these puzzles, and the successful participant is rewarded with a certain amount of cryptocurrency, commonly referred to as mining rewards.

This process not only enables new coins to enter circulation but also confirms transaction legitimacy. As the digital currency landscape expands, many people are drawn to the mining world, hoping to leverage their computing resources for profit.

Brief History of Cryptocurrency Mining

The concept of cryptocurrency mining took root with the introduction of Bitcoin in 2009 by the pseudonymous figure Satoshi Nakamoto. Originally, mining was an accessible venture, with users able to compete on standard personal computers. However, as Bitcoin gained popularity and the network grew, mining evolved significantly.

Key milestones in the evolution of cryptocurrency mining include:

- 2009: Bitcoin launched; mining could be done with basic computer hardware.

- 2010: The first mining pools emerged, allowing miners to collaborate and increase their chances of earning rewards.

- 2011: With the rise of altcoins, miners began to diversify their activities across different blockchain networks.

- 2013: The advent of ASIC (Application-Specific Integrated Circuit) miners revolutionized efficiency, allowing miners to outperform traditional hardware dramatically.

Throughout this journey, the landscape has continued transforming, driven by technological advancements and an ever-expanding interest in cryptocurrencies. The mining process has become more sophisticated, requiring specialized equipment and expertise. This historical context helps understand the current complexities and potential future of cryptocurrency mining.

Basics of Cryptocurrency Mining

How Cryptocurrency Mining Works

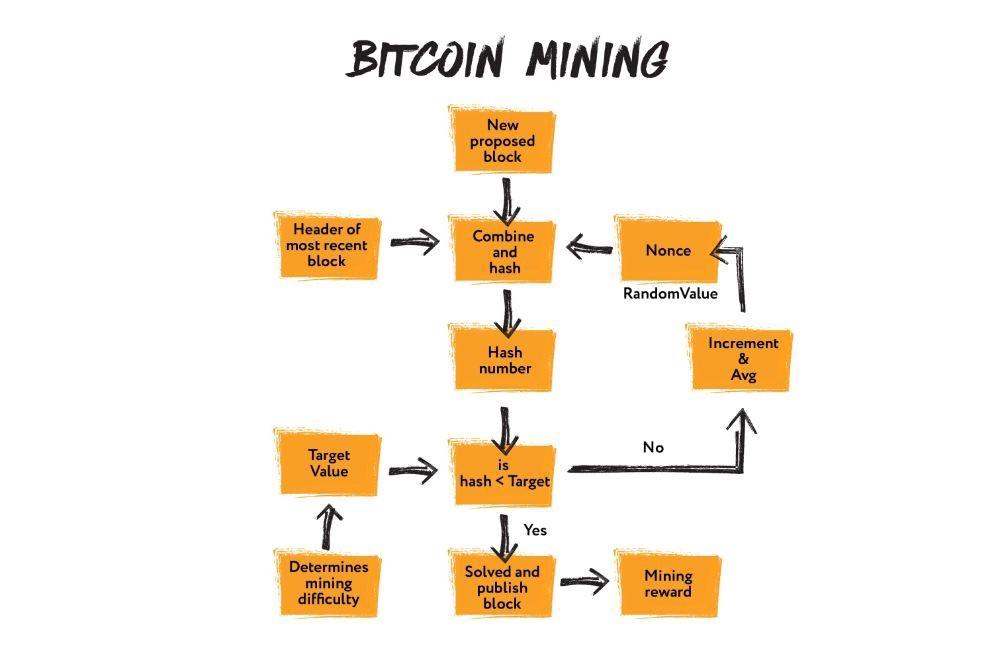

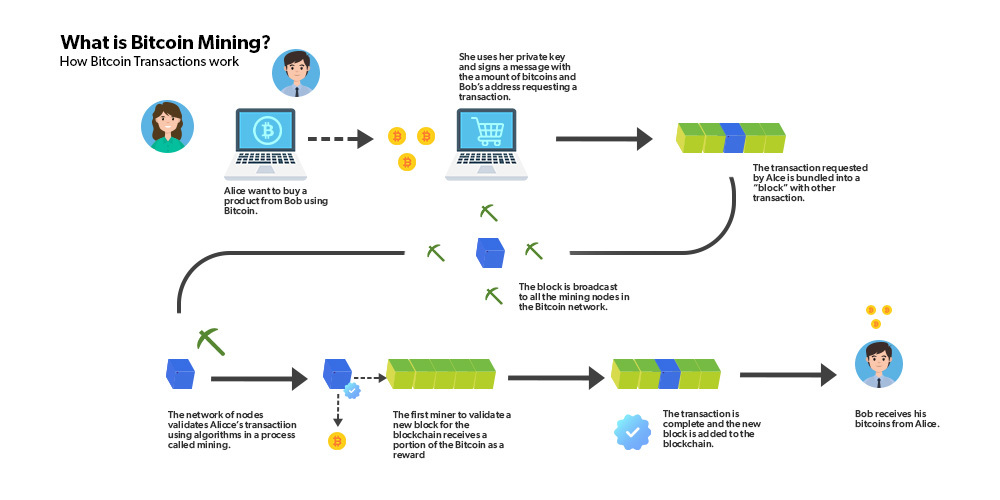

At its core, cryptocurrency mining is a blend of computer science and finance, driven by a decentralized network called the blockchain. When a transaction is initiated, it is placed in a pool, waiting to be verified. Here’s a simplified breakdown of how the mining process works:

- Transaction Verification: Miners gather transactions and organize them into a block. These blocks are then linked to the existing blockchain.

- Solving the Puzzle: To add this new block, miners must solve a complex mathematical puzzle known as a cryptographic hash problem. The first miner to crack this code submits the solution to the network.

- Consensus and Validation: Other miners verify the submitted solution. Once validated, the new block is added to the blockchain, and the miner receives a reward—typically in the form of new cryptocurrency coins and transaction fees.

For many enthusiasts dabbling in cryptocurrency, understanding this process can be transformative. It highlights the power of collaboration and the underlying technology that sustains digital currencies.

Types of Cryptocurrencies Mined

While Bitcoin remains the gold standard in cryptocurrency mining, many others share the spotlight. Here are some notable examples of cryptocurrencies that are commonly mined:

- Ethereum (ETH): The second-largest cryptocurrency by market capitalization; however, it’s transitioning from mining to a Proof of Stake model.

- Litecoin (LTC): Created as a “lighter” version of Bitcoin, it allows for faster transaction confirmations.

- Monero (XMR): Focuses on privacy, utilizing unique algorithms that make anonymous transactions possible.

- Zcash (ZEC): Similar to Monero but offers optional anonymity for transactions.

By engaging in cryptocurrency mining, enthusiasts not only contribute to the security of these networks but also open themselves to the potential rewards associated with various digital currencies. As mining techniques and technologies evolve, so does the diversity of cryptocurrencies available for mining, making it a continually exciting sector within the digital finance landscape.

Mining Process Explained

Blockchain and Mining

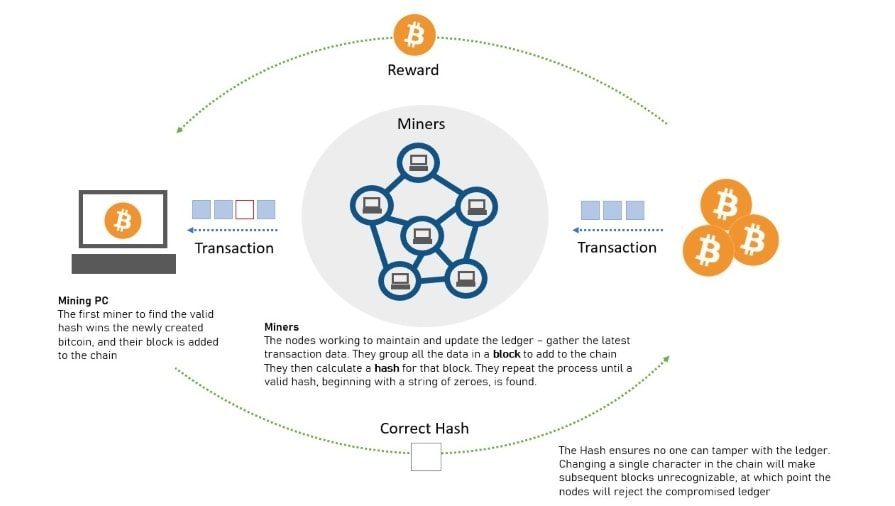

The relationship between blockchain technology and cryptocurrency mining is fundamental and fascinating. A blockchain serves as a digital ledger that records all transactions across a network of computers. Think of it as a highly secure, decentralized database that anyone can access but can only be updated by verified participants—namely, miners.

Here’s how the mining process integrates with the blockchain:

- Transaction Gathering: When users make transactions, those details are broadcasted to the network, where miners pick them up.

- Block Creation: Miners organize these transactions into blocks.

- Verification: By solving complex mathematical puzzles, miners validate these transactions.

- Chain Updating: Successfully verified blocks are linked to previous blocks, forming the complete blockchain, which serves as a permanent record.

This cohesive structure ensures that the decentralized nature of cryptocurrencies remains intact, giving users confidence in the security of their transactions.

Proof of Work vs. Proof of Stake

Two primary mechanisms govern how transactions are verified on blockchains: Proof of Work (PoW) and Proof of Stake (PoS). Each has its advantages and unique characteristics.

- Proof of Work (PoW):

- Utilizes computational power to solve puzzles.

- Miners compete to validate transactions and add blocks to the chain.

- Known for its energy-intensive nature; Bitcoin primarily uses PoW.

- Proof of Stake (PoS):

- Validators (not miners) hold a certain amount of the cryptocurrency as collateral.

- Transactions are validated based on the number of coins held, reducing energy consumption.

- Ethereum is making a transition from PoW to PoS, which could significantly affect its mining landscape.

In summary, understanding these two mechanisms provides insight into not just how miners operate but also the broader implications for the sustainability and efficiency of the cryptocurrency ecosystem. As new technologies emerge, the debate continues regarding which method holds the key to the future of digital currency mining.

Mining Equipment and Software

Hardware Requirements

Entering the world of cryptocurrency mining requires a keen understanding of the hardware involved, as it directly influences efficiency and profitability. The type of hardware you choose will depend on which cryptocurrency you plan to mine and your budget. Here are some common hardware options:

- ASIC Miners (Application-Specific Integrated Circuits):

- Designed specifically for mining cryptocurrencies like Bitcoin.

- Highly efficient and faster than standard GPUs, but they can be expensive.

- Examples include Bitmain’s Antminer and MicroBT’s Whatsminer.

- GPUs (Graphics Processing Units):

- Versatile and can mine a variety of cryptocurrencies.

- More accessible for beginners due to availability (often used in gaming rigs).

- Great for mining altcoins such as Ethereum, Monero, or Zcash.

- FPGAs (Field-Programmable Gate Arrays):

- A middle ground between ASICs and GPUs, offering flexibility and efficiency.

- Can be programmed for specific tasks but require advanced technical knowledge.

Investing in quality equipment can lead to better mining success, but it’s essential to balance cost and performance.

Mining Software Options

Once you have the appropriate hardware, selecting the right mining software is the next critical step. The software serves as the interface between your hardware and the cryptocurrency network. Here are some popular options:

- CGMiner: A long-standing favorite, CGMiner supports both ASIC and FPGA hardware and offers robust features for performance optimization.

- BFGMiner: Similar to CGMiner but focuses on ASIC mining, it provides in-depth monitoring abilities.

- EasyMiner: A user-friendly option ideal for beginners; it offers a graphical interface and supports both CPU and GPU mining.

- MinerGate: This mining pool software allows users to mine several cryptocurrencies simultaneously, simplifying the process for novices.

Choosing the right combination of hardware and software can greatly enhance your mining experience. Remember, thorough research can uncover tools and solutions tailored to your mining goals, helping you navigate the digital currency landscape with greater ease and profitability.

Mining Pools and Solo Mining

Pros and Cons of Mining Pools

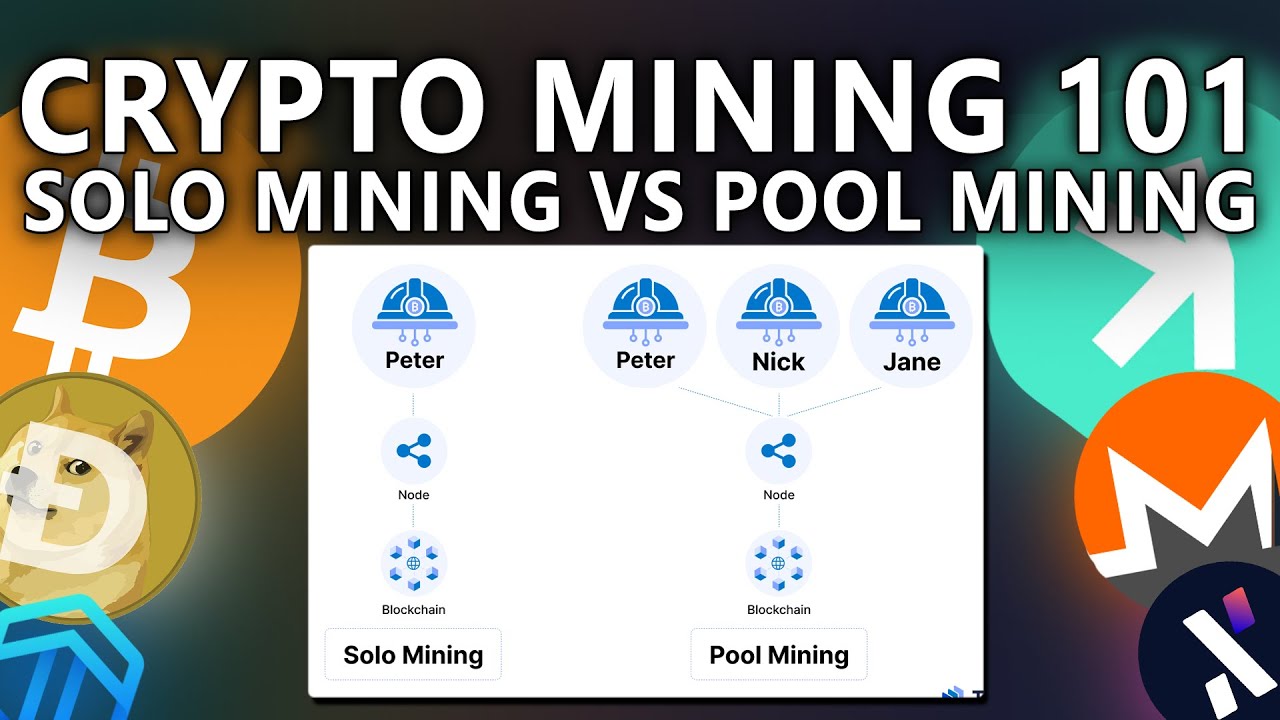

When embarking on the mining journey, one key decision miners face is whether to join a mining pool or go solo. Mining pools, where miners combine their computational power to increase success odds, have become increasingly popular. Here are some pros and cons of mining pools:

Pros:

- Consistent Rewards: By pooling resources, miners can earn smaller, more frequent payouts rather than relying on the uncertain success of solo mining.

- Lower Variability: Mining pools reduce the financial hardship associated with the unpredictability of block rewards—it’s like receiving a paycheck rather than relying on commission.

- Enhanced Support: Joining a pool offers access to community support, resources, and shared knowledge, which can be invaluable for beginners.

Cons:

- Fees: Most mining pools charge a fee, usually a percentage of the mined rewards, which can cut into profits.

- Centralization Risk: The rise of strong mining pools may lead to greater centralization, which runs contrary to the decentralized ethos of cryptocurrencies.

Overall, mining pools can offer a more stable income, especially for those starting their mining journey.

How Solo Mining Differs

Solo mining, on the other hand, involves mining independently without joining a pool. While it can be appealing for some, it comes with its own set of challenges.

In solo mining, miners work independently to solve blocks and validate transactions. Here are key distinctions:

- Higher Potential Rewards: If a miner manages to solve a block on their own, they retain the entire block reward, which can be significantly higher than pooled rewards.

- Increased Difficulty: The likelihood of success is notably lower, particularly for established cryptocurrencies like Bitcoin, where competition is fierce.

- Resource Intensity: Solo miners must invest substantially in high-performing hardware and bear the costs of energy consumption, often making it an expensive endeavor.

Ultimately, solo mining offers independence and potential for larger rewards, but it requires considerable resources and a stomach for risk. Whether opting for a pool or going solo, miners should evaluate their goals and resources before diving into the world of cryptocurrency mining.

Understanding Mining Rewards

Block Rewards

At the heart of cryptocurrency mining lies the concept of mining rewards, which incentivizes miners to secure the network and validate transactions. One of the primary sources of these rewards is the block reward.

A block reward is essentially a set number of newly minted coins given to miners upon successfully adding a new block to the blockchain. For example:

- Bitcoin currently rewards 6.25 BTC per block (as of the last halving in 2020).

- Ethereum, before its transition to Proof of Stake, offered miners 2 ETH per block.

This block reward serves as both an incentive for miners and a centralized method for introducing new coins into circulation. As the network matures, block rewards typically decrease over time, creating an incentive structure that helps control the overall supply of the cryptocurrency.

Transaction Fees

In addition to block rewards, miners also earn income through transaction fees. Every time a cryptocurrency transaction is made, users can choose to include a fee, which is paid to miners for their role in confirming the transaction. Here’s how transaction fees work:

- Variable Fees: Fees can vary based on network congestion. Higher fees can speed up the confirmation process, encouraging miners to prioritize those transactions.

- Supplemental Income: As block rewards decrease (especially in assets like Bitcoin), transaction fees become crucial for miners to sustain their operations. For example, during peak trading times, fees can surge, significantly boosting miners’ earnings.

In summary, understanding both block rewards and transaction fees is vital for anyone exploring the mining ecosystem. Together, they form the financial backbone that motivates miners to invest their resources in securing and validating the transactions that make the world of cryptocurrency possible. As new technologies and trends emerge, the dynamics of these rewards continue to evolve, highlighting the ever-changing nature of cryptocurrency mining.

Energy Consumption and Environmental Impact

Energy Usage in Cryptocurrency Mining

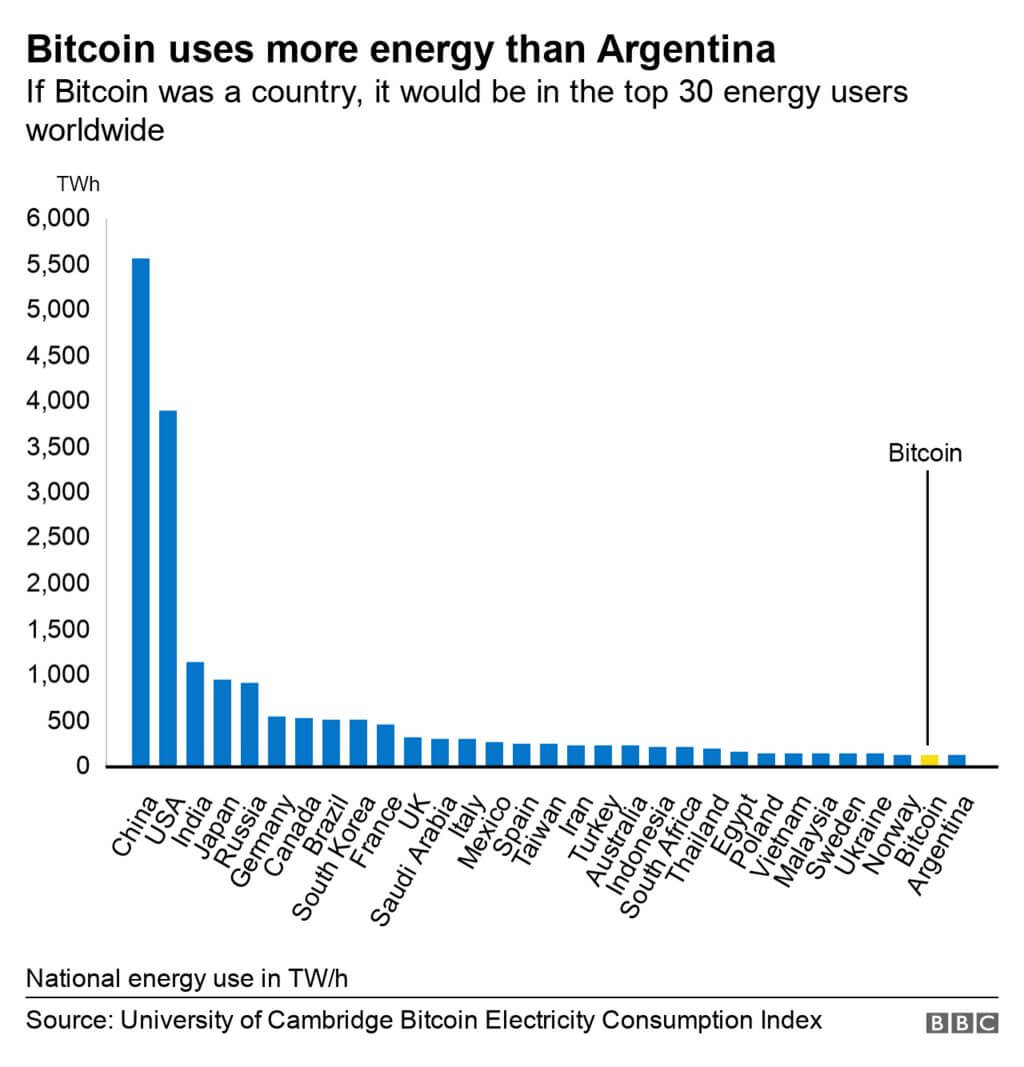

One of the biggest discussions surrounding cryptocurrency mining revolves around its energy consumption. As miners harness computational power to solve complex puzzles, the energy costs can become substantial. For instance, estimates suggest that Bitcoin mining alone consumes more electricity annually than certain countries, raising eyebrows globally.

Here are some key points about energy usage in mining:

- High Power Requirements: Mining rigs, especially those using ASICs, require constant, high energy input to function efficiently.

- Data Center Densities: Many miners set up large-scale operations in data centers, further amplifying energy demand.

- Carbon Footprint: The source of power significantly affects the environmental impact; mining in regions reliant on fossil fuels exacerbates carbon emissions.

This energy usage has sparked debates about sustainability and the environmental footprint of cryptocurrencies.

Sustainability and Green Mining Practices

In response to concerns over energy consumption, the cryptocurrency community has started exploring more sustainable mining practices. Here’s how miners are pivoting towards green solutions:

- Renewable Energy Sources: Many miners are setting up operations in regions with abundant renewable resources, such as solar, wind, or hydropower. For example, companies have been known to utilize excess energy from hydroelectric plants to power their rigs.

- Energy-Efficient Hardware: Innovation in mining equipment is steering towards more energy-efficient models that require less power without compromising performance.

- Carbon Credits: Some miners are investing in carbon offsetting projects, allowing them to balance their environmental impact with initiatives aimed at sustainability.

By focusing on sustainable mining practices, the cryptocurrency community is not only addressing environmental concerns but also shaping a more responsible approach to this digital frontier. As attitudes toward energy consumption continue to evolve, these efforts signify a promising shift towards a greener future in cryptocurrency mining.

Risks and Challenges in Mining

Security Concerns

As cryptocurrency mining continues to gain traction, various security concerns come into play that every miner should acknowledge. The decentralized nature of this realm arguably enhances security, but it doesn’t eliminate risks. Here are some critical security challenges miners face:

- 51% Attacks: If a single entity controls more than half of a network’s mining power, it can manipulate transactions, double-spend coins, and undermine the blockchain’s integrity. Although rare, this scenario can severely damage a cryptocurrency’s reputation.

- Hacks and Theft: Mining operations are often targets for cybercriminals seeking to steal funds or hijack mining rigs. It’s crucial for miners to implement strong security protocols, including two-factor authentication and secure wallets.

- Internal Vulnerabilities: Sometimes, miners may inadvertently expose their operations to risks by neglecting rigorous security measures. For example, using poorly secured networks can allow unauthorized access to sensitive systems.

Understanding these concerns is vital for cultivating a secure mining environment.

Regulatory Challenges

Another major hurdle facing cryptocurrency miners is the complex and evolving landscape of regulations. With varying laws from one jurisdiction to another, miners can find themselves navigating a labyrinth of compliance requirements.

Some key regulatory challenges include:

- Licensing Requirements: Different countries may require miners to obtain specific licenses or permits, adding bureaucratic burdens to their operations.

- Tax Implications: The tax treatment of cryptocurrency transactions differs widely, leading to uncertainty for miners regarding income tax, capital gains tax, and other financial obligations.

- Future Legislation: As governments worldwide grapple with the implications of cryptocurrencies, new laws and regulations can emerge, swaying the market and impacting miners’ profitability.

Staying informed about regulatory trends is essential for miners to ensure compliance and mitigate risks. As the cryptocurrency world matures, understanding both security concerns and regulatory challenges will be crucial for leveraging success in mining. Embracing an agile approach can help miners navigate these complexities, securing their operations and investments in a rapidly changing landscape.

Future Trends in Cryptocurrency Mining

Shift to Proof of Stake

As discussed earlier, energy consumption remains a critical concern in the cryptocurrency mining landscape. One of the most significant trends shaping the future of mining is the shift from Proof of Work (PoW) to Proof of Stake (PoS). This new consensus mechanism offers several advantages that appeal to both environmental advocates and miners alike.

- Energy Efficiency: PoS drastically reduces the energy required for network security. Instead of competing to solve complex puzzles, miners (validators) are chosen based on the number of coins they hold and are willing to “stake.”

- Accessibility: This transition allows more participants to engage in the mining process without the need for expensive hardware. It democratizes access, enabling holders of the cryptocurrency to earn rewards, rather than only those with massive computational resources.

- Long-term Sustainability: Major networks like Ethereum are transitioning to PoS, inspiring other cryptocurrencies to follow suit, indicating a larger trend toward sustainability within the blockchain sphere.

With PoS gaining traction, the mining sector is moving towards a more eco-friendly model.

Emerging Mining Technologies

In addition to consensus mechanism changes, emerging technologies are reshaping how mining is conducted. Here are some exciting developments to watch:

- AI-Powered Mining: Artificial intelligence algorithms can optimize mining operations by efficiently managing power usage and maximizing profits. These smart systems can predict market trends and adjust mining strategies accordingly.

- Cloud Mining: This model enables users to rent mining power from data centers, avoiding the costs and complexities of hardware maintenance. It makes mining accessible to those who want to dip their toes without significant investment.

- Next-Gen Hardware: Continuous advancements in ASIC and GPU technology are paving the way for more efficient and powerful mining rigs that consume less energy while delivering higher hash rates.

Overall, as the cryptocurrency landscape evolves, staying attuned to trends such as the shift to Proof of Stake and the rise of emerging technologies will be crucial for miners looking to remain competitive. Adapting to these changes is vital for maximizing profitability and embracing a sustainable future in cryptocurrency mining. As the industry progresses, innovative solutions will undoubtedly reshape the way we approach mining.

Conclusion and Key Takeaways

Summary of Cryptocurrency Mining Basics

As we wrap up our exploration of cryptocurrency mining, it’s clear that this complex world is built on foundational concepts that every aspiring miner should understand. Cryptocurrency mining involves both the verification of transactions and the addition of new blocks to a blockchain. This intricate dance requires not only robust hardware and sophisticated software but also an awareness of energy consumption and prevailing security concerns.

In summary:

- Types of Mining: Miners can engage in solo mining or join mining pools, each with its pros and cons.

- Rewards Mechanism: The combination of block rewards and transaction fees serves as the primary incentive for miners.

- Evolving Landscape: The move toward Proof of Stake reflects an industry shift focused on sustainability and efficiency.

Importance of Mining in the Cryptocurrency Ecosystem

Mining plays a pivotal role in the cryptocurrency ecosystem. It not only secures the network against fraudulent activities but also ensures the continuous evolution of digital currencies. By validating transactions, miners help maintain the trust necessary for cryptocurrencies to function effectively in the marketplace.

- Decentralization: Mining supports the decentralized nature of cryptocurrencies, allowing individuals to participate in the currency system without reliance on traditional banking institutions.

- Innovation Driver: The need for efficient mining solutions fuels constant technological innovation, leading to breakthroughs in hardware and software.

- Community Building: Mining encourages collaboration among participants, helping to foster a sense of community in the digital economy.

As the influence of cryptocurrency continues to expand, understanding the fundamentals of mining will enable both new and seasoned participants to navigate this exciting space more effectively. The journey into cryptocurrency mining promises to be dynamic, with emerging trends and innovations continuously shaping the future of digital currencies. Embracing these changes will be essential for those looking to stay ahead in the ever-evolving landscape of cryptocurrency.