Understanding the Wave Platform

Overview of Wave Accounting Software

Wave Accounting Software has emerged as a transformative tool for small business owners. Essentially, it’s a free, cloud-based accounting platform designed explicitly for those seeking simplicity without sacrificing functionality. With its user-friendly interface, even individuals without a background in finance can manage their accounting effectively.

As someone who has navigated the financial landscape of small businesses, I can attest to the ease Wave provides—allowing you to focus more on growing your business rather than drowning in paperwork.

Features and Benefits of Wave for Small Businesses

Wave offers a wide range of features, making it a preferred choice for small entrepreneurs. Key benefits include:

- Invoicing: Quickly create and send professional invoices.

- Expense Tracking: Easily manage and categorize expenses.

- Bank Integration: Seamless connections with bank accounts for automatic transaction syncing.

- Reports: Generate essential financial reports for easy analysis.

This combination of features helps small business owners not only to save time but also to enhance their financial clarity, ultimately revolutionizing small business accounting.

Getting Started with Wave

Setting Up a Wave Account

Getting started with Wave is a breeze—setting up your account only takes a few minutes. Simply visit the website and click on the “Sign Up” button. You’ll need to provide some basic information, including your email and a secure password.

Having personally set up my Wave account, I can say the intuitive process ensures you’re up and running without a hitch.

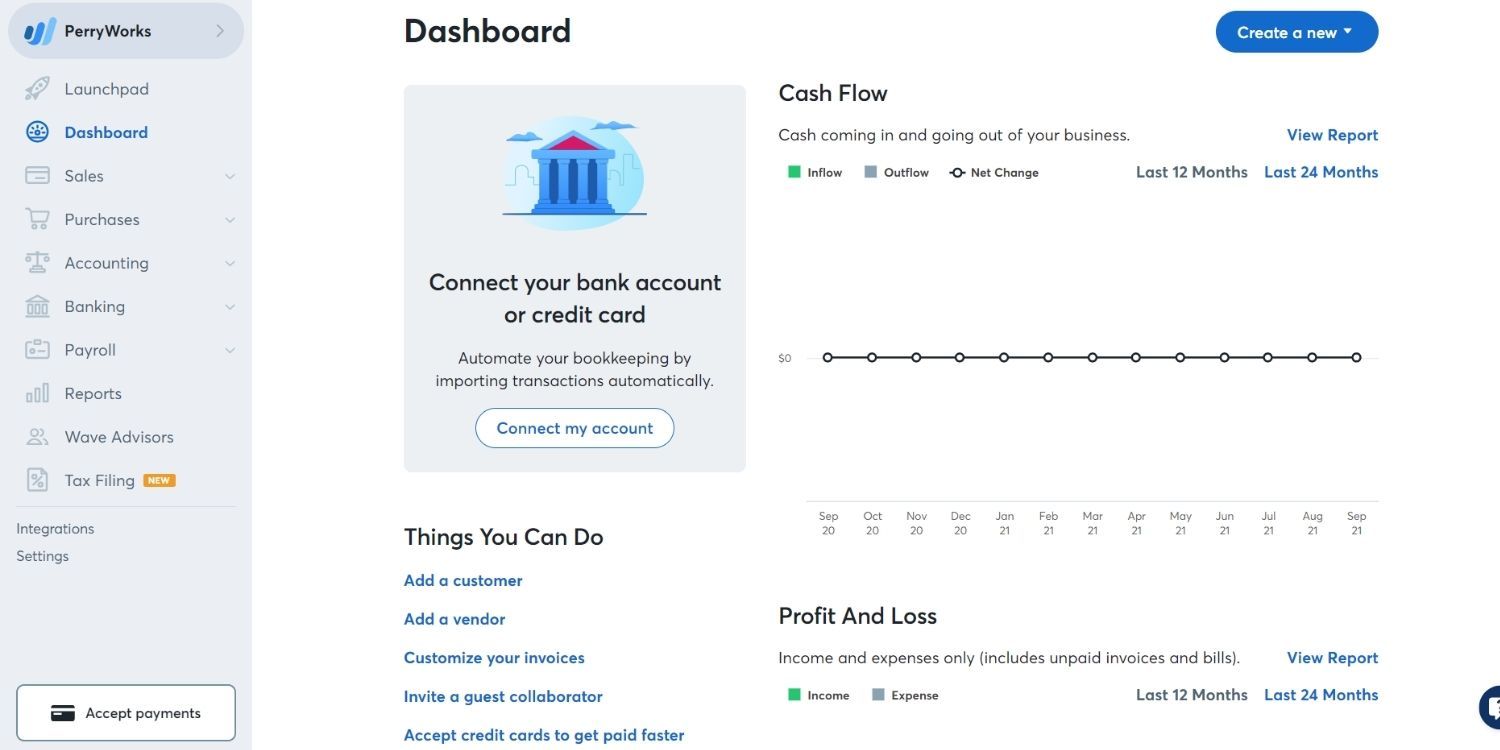

Navigating the Wave Dashboard

Once logged in, the Wave dashboard greets you—it’s your control center. Here you can easily access:

- Invoicing: Create invoices effortlessly.

- Expense Tracking: Monitor your spending at a glance.

- Reports: Get insights into your business’s financial health.

All these features are just a click away, making it simple to track your finances in real time.

Integrating Wave with Bank Accounts

One of Wave’s standout features is its ability to integrate with your bank accounts. To set this up, navigate to the “Banking” tab.

- Connect Accounts: Link your business bank account to Wave for automatic transaction syncing.

- Import Transactions: Easily import existing transactions, saving time in data entry.

As someone who values efficiency, this integration allows me to streamline bookkeeping and stay on top of my finances with minimal effort. It’s just another way Wave revolutionizes small business accounting.

Wave for Invoicing and Payments

Creating and Sending Invoices

When it comes to invoicing, Wave streamlines the process like a charm. Creating and sending invoices is as simple as clicking a few buttons. You can customize your invoices with your brand logo, set payment terms, and even include items and services you offer.

Having used this feature, I appreciate how quickly I can generate invoices that look professional. Plus, you can send them directly via email, ensuring your clients receive them instantly.

Accepting Online Payments through Wave

Wave also makes accepting online payments a hassle-free experience. Once your invoices are sent, clients can pay directly through the link included, and you can choose to accept major credit cards or bank transfers. This integration enhances cash flow and reduces the wait time for payments.

- Convenience for Clients: Easy payment methods create a positive experience.

- Automatic Tracking: Payments are automatically recorded in your finance reports, reducing manual data entry.

Managing Invoices and Payment Records

After sending invoices, managing them is equally straightforward. Wave’s dashboard allows you to track the status of each invoice, whether it’s paid, pending, or overdue.

- Payment Reminders: Set automatic reminders for overdue invoices.

- Comprehensive Record Keeping: All payment records are stored systematically for easy access.

With these features, Wave consolidates the invoicing and payment process, allowing you to focus on what truly matters—growing your business. It’s a powerful demonstration of how Wave revolutionizes small business accounting.

Tracking Expenses and Receipts

Recording Expenses in Wave

Tracking expenses is crucial for maintaining a healthy financial outlook, and Wave makes this process incredibly efficient. You can manually input expenses by selecting the relevant category, amount, and date, or simply sync with your bank account to import transactions automatically.

From my own experience, this feature reduces the likelihood of missing expenses, ensuring that every dollar is accounted for in your financial reports.

Uploading and Organizing Receipts

Wave allows you to upload and organize receipts directly within the platform. You can either take a picture of your receipt using the mobile app or upload a digital copy through your dashboard.

- Categorization: Assign each receipt to specific expenses for easy tracking.

- Search Function: Quickly find receipts by category, date, or amount.

This feature has been a game-changer for me, as I no longer have to sift through piles of paper receipts come tax season.

Monitoring Spending and Expense Reporting

Monitoring your spending is a breeze with Wave’s expense reporting tools. The dashboard provides a snapshot of your spending habits, allowing you to identify trends and make informed financial decisions.

- Monthly Reports: Generate reports to analyze spending by category.

- Budgeting Insights: Use these reports to create budgets and limit unnecessary expenditures.

With these robust tools, Wave empowers you to stay on top of your expenses, further enhancing how Wave revolutionizes small business accounting. It ensures financial clarity so you can focus on what really matters—growing your business.

Wave for Financial Reporting

Generating Financial Reports in Wave

Once you’ve diligently tracked expenses and managed invoices, it’s time to dive into financial reporting—one of Wave’s strongest suits. Generating financial reports is a seamless process. With just a few clicks, you can produce essential documents like profit and loss statements and balance sheets, which are crucial for assessing your business’s financial health.

Having relied on these reports, I find they provide invaluable insights that help steer strategic decisions.

Analyzing Business Performance with Wave Reports

Analyzing your business performance becomes intuitive with Wave’s reporting features. The platform allows you to view:

- Trends Over Time: Identify patterns in revenue and expenses.

- Key Metrics: Track important indicators like gross profit margins and net income.

These insights shed light on how your business is performing and where improvements can be made. I often use these analyses to pinpoint areas that can drive growth.

Tax Preparation and Reporting with Wave

When tax season rolls around, having organized financial reports makes all the difference. Wave simplifies tax preparation by providing up-to-date reports that are ready for your accountant or for filing.

- Expense Categorization: Ensure every deductible expense is clearly classified.

- Year-End Summaries: Generate comprehensive reports that summarize all financial activity over the year.

This feature has alleviated much of the stress during tax time, allowing me to focus on other business responsibilities. Wave’s financial reporting capabilities truly highlight how it revolutionizes small business accounting, making it easier to stay organized, compliant, and focused on future growth.

Integrations and Add-Ons

Connecting Wave with Third-Party Apps

One of the standout features of Wave is its ability to integrate with various third-party applications, which enhances its functionality. Connecting Wave with tools like PayPal, Stripe, or Shopify can streamline your operations.

For instance, I once connected my Shopify store to Wave, allowing my sales and expenses to sync automatically. This integration saved me hours of manual data entry and reduced discrepancies.

- Easy Setup: Most integrations can be completed in just a few clicks.

- Real-Time Updates: Keep your financial data accurate and current.

Exploring Additional Features and Integrations

Beyond basic integrations, Wave also offers additional features that can further enhance your accounting experience. For example, the Wave App Store provides access to various add-ons that cater to specific business needs, such as:

- Payroll Services: Streamline your payroll processes with automatic calculations and file submissions.

- Receipt Scanning: Utilize apps that allow you to scan and upload receipts effortlessly.

Exploring these features can significantly improve how you manage your finances. By leveraging Wave’s ecosystem of integrations and add-ons, I have seen firsthand how it can revolutionize small business accounting, making it not just a tool, but a comprehensive solution tailored for efficiency.

Wave Customer Support and Resources

Accessing Wave Help Center and Support

Navigating a new accounting platform can be daunting, but Wave’s customer support and resources are designed to ease that transition. The Wave Help Center is a treasure trove of information, offering articles and step-by-step guides tailored to common questions.

Whenever I’ve faced any challenges, I’ve found their support team responsive and helpful. Just visit the Help Center to access:

- FAQs: Answers to frequently asked questions.

- Contact Options: Easily get in touch via email or chat.

Learning from Wave Tutorials and Guides

Wave also provides an array of tutorials and guides that can significantly enhance your understanding of the platform. These resources cover everything from basic setup to intricate features.

I often turn to these tutorials when exploring new functionalities. They are:

- Video Tutorials: Visual guides that take you through processes in real time.

- Written Guides: Detailed instructions available for reference.

Community Forums and User Support

In addition to official support, Wave boasts a vibrant community forum where users share insights and solutions. Engaging with fellow Wave users can be incredibly beneficial.

- User Experiences: Learn from the challenges and successes of other small business owners.

- Collaborative Problem-Solving: Get quick answers and tips from experienced users.

These support systems highlight Wave’s commitment to user satisfaction and empowerment. Personally, utilizing these resources has reinforced how Wave revolutionizes small business accounting, providing not just tools but a supportive community to navigate financial management effectively.

Security and Data Protection in Wave

Overview of Wave Security Measures

When it comes to managing financial data, security should be a top priority, and Wave understands that well. They employ robust security measures to protect user information, including:

- Encryption: All data is encrypted both in transit and at rest, ensuring sensitive information stays secure.

- Role-Based Access: You can assign different access levels for team members, keeping your data safeguarded.

From my experience, knowing that my financial information is secured with top-notch encryption eases any worries I had while transitioning to the platform.

Data Backup and Recovery in Wave

In addition to security measures, Wave provides reliable data backup and recovery options. The platform automatically backs up your data in real time, which means:

- Peace of Mind: You don’t have to worry about losing important financial records due to unexpected outages.

- Easy Recovery: If issues arise, recovering your data is straightforward and user-friendly.

This commitment to security and data integrity has reinforced my confidence in using Wave for my small business accounting needs. It’s just one more way Wave revolutionizes small business accounting while ensuring that your financial information remains protected.

Pricing Plans and Subscription Options

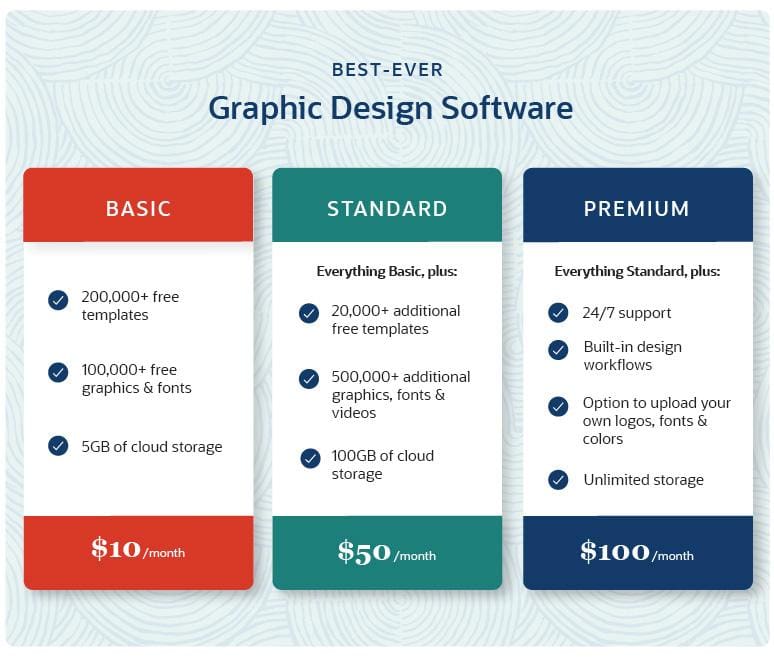

Comparing Wave’s Free and Paid Plans

One of the most compelling features of Wave is that it offers a robust free plan that appeals to small business owners looking to manage their finances without breaking the bank. The free plan includes essential features like invoicing, expense tracking, and financial reporting.

However, if you’re seeking more advanced capabilities—such as payroll services or credit card processing—you’ll need to consider Wave’s paid options. Personally, I’ve explored both the free and paid plans, and while the free version is excellent for many startups, certain premium features can be worthwhile for growth-oriented businesses.

Understanding Pricing Structure and Features

Wave’s pricing structure is straightforward. Here’s a breakdown of what you can expect:

- Free Plan: Includes invoicing, expense tracking, and basic reporting.

- Paid Add-Ons:

- Payroll Services: Starting at a competitive rate, tailored for your needs.

- Payment Processing Fees: A small percentage per transaction for credit card processing.

This transparent pricing makes it easy to understand what you’re paying for and helps you plan your budget accordingly. By evaluating your specific needs, you can determine which plan or combination of add-ons best meets your financial management requirements, continuing to showcase how Wave revolutionizes small business accounting while remaining budget-friendly.

Future Trends and Developments in Wave

Evolving Features and Updates in Wave

As technology advances, so does Wave, with a commitment to continually evolving its features. Recent updates have introduced enhanced reporting capabilities and improved user interfaces, making it even easier for small business owners to navigate their financial data.

I’ve noticed significant improvements in the app’s user experience each time they roll out a new update. Here are some anticipated features:

- AI-Powered Insights: Expect advanced analytics that will help in forecasting financial trends.

- Integration with Emerging Technologies: Such as blockchain for enhanced security.

These updates ensure Wave remains relevant and effective in a rapidly changing landscape.

Potential Impact on Small Business Accounting Community

The impact of these evolving features on the small business accounting community cannot be overstated. As more entrepreneurs adopt Wave, there’s a collective shift toward accessibility and efficiency in financial management.

- Cost-Effective Solutions: Democrats financial tools previously limited to larger enterprises.

- Community Knowledge Sharing: As users adopt new features, the potential for shared knowledge increases, enriching the overall experience.

In essence, as Wave continues to innovate, it not only revolutionizes small business accounting but also fosters a supportive ecosystem where small business owners can thrive together. This community-focused direction heralds a bright future for financial management.