Introduction

Overview of Machine Learning in Finance

In recent years, the financial sector has witnessed a dramatic transformation, largely fueled by advancements in technology. Machine learning is at the forefront of this revolution, enabling institutions to analyze vast datasets, uncover patterns, and automate processes like never before. By utilizing algorithms that can learn from historical data, financial firms are not only enhancing their operational efficiency but also improving their predictive capabilities.

Consider how a bank might use machine learning for credit risk assessment. Instead of relying solely on traditional credit scores, they can incorporate a multitude of factors—transaction history, behavioral data, and even social media activity—to gain a more nuanced understanding of a borrower’s creditworthiness.

Significance of Machine Learning in the Financial Sector

The significance of machine learning in finance cannot be overstated. As competition intensifies and customer expectations rise, financial institutions are turning to machine learning solutions to stay ahead. Here are a few ways this technology is making a difference:

- Improved Risk Assessment: Machine learning models can quickly adapt to new information, ensuring that risk assessments are always up-to-date.

- Enhanced Customer Experience: By leveraging data insights, firms can tailor products and services, providing a personalized customer journey.

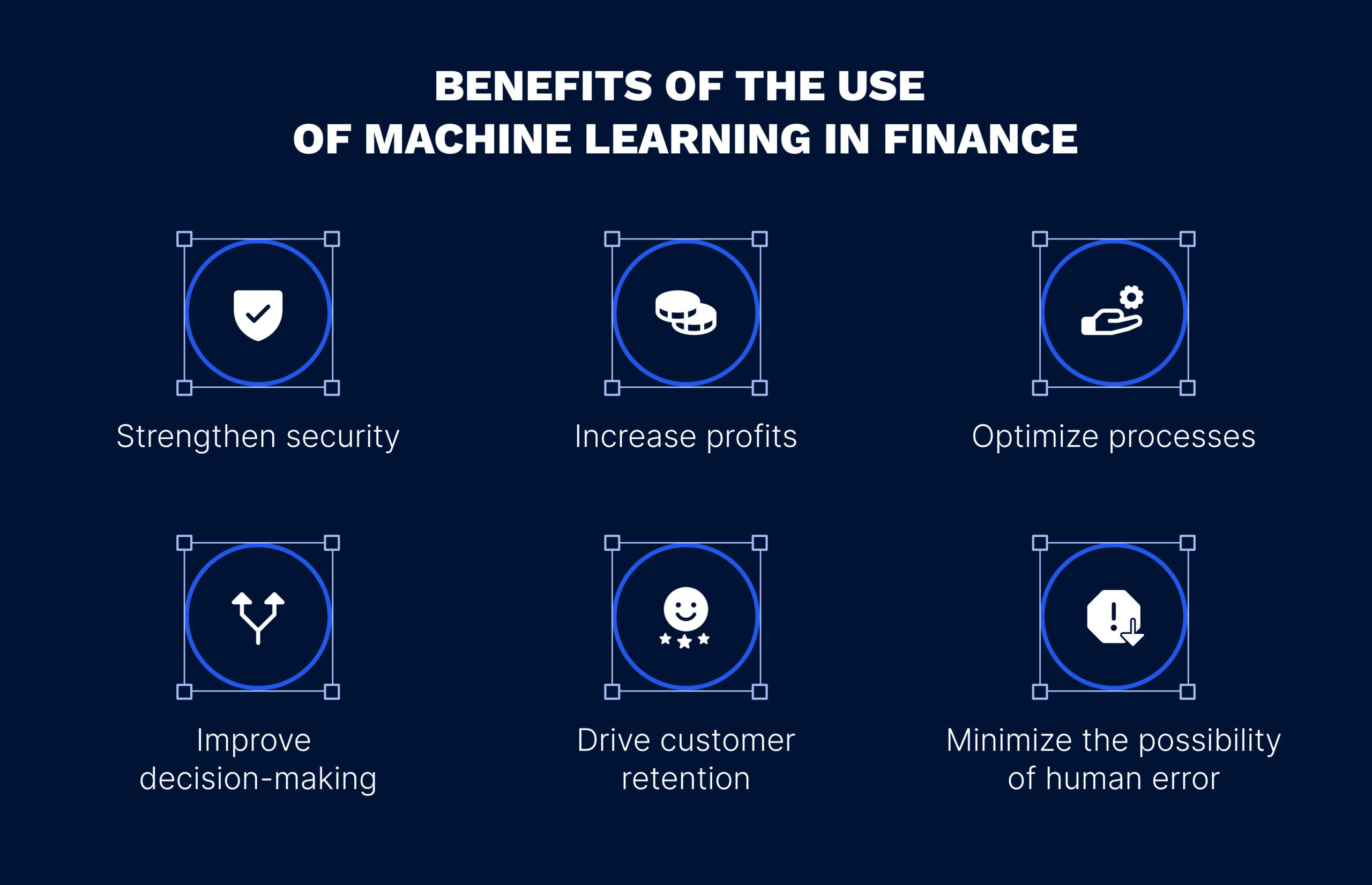

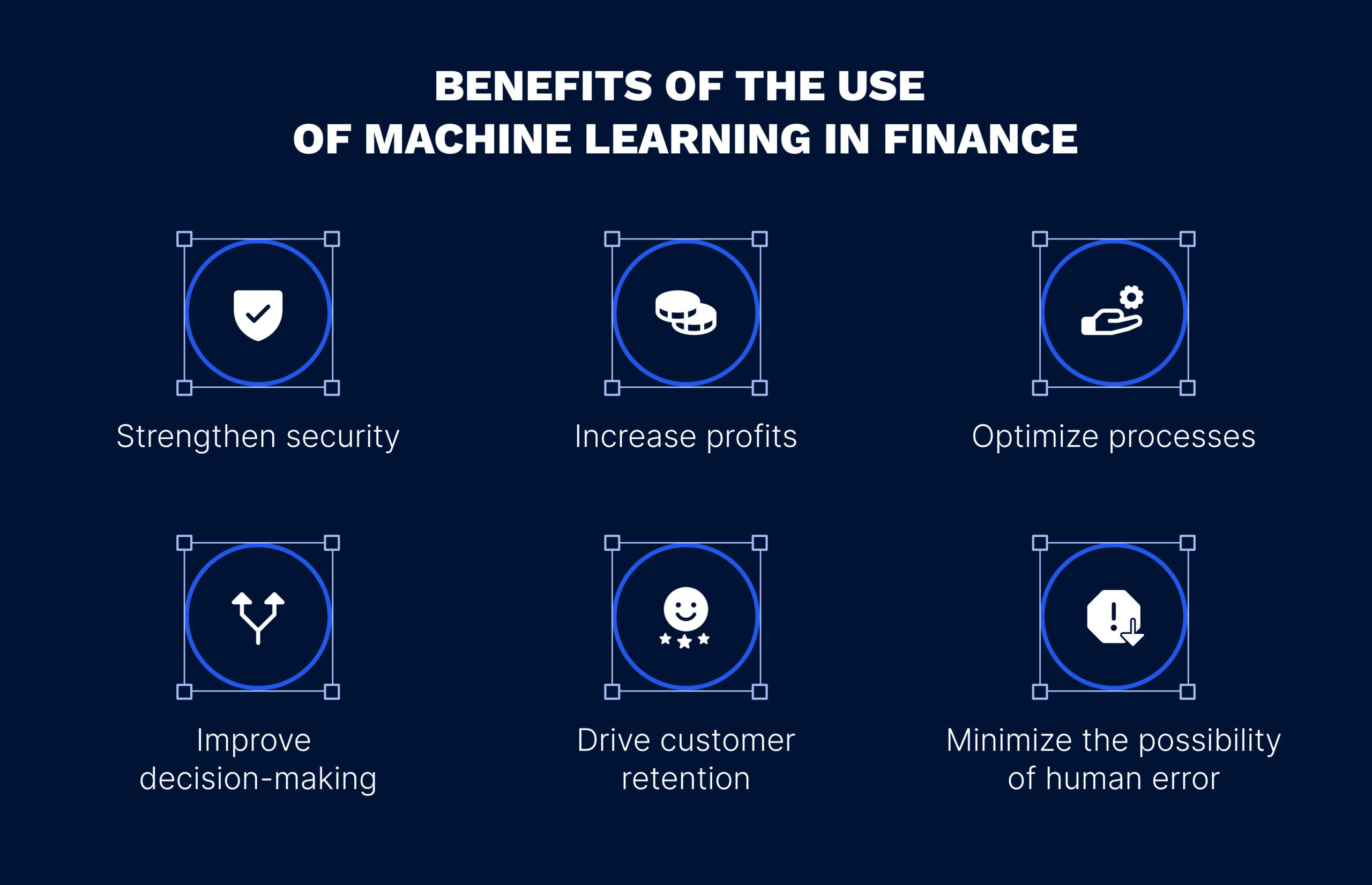

- Operational Efficiency: Automated processes reduce human error and increase speed, drastically improving productivity.

As we delve deeper into this topic, it will become clear how machine learning is revolutionizing the finance sector, leading to smarter, more informed decision-making.

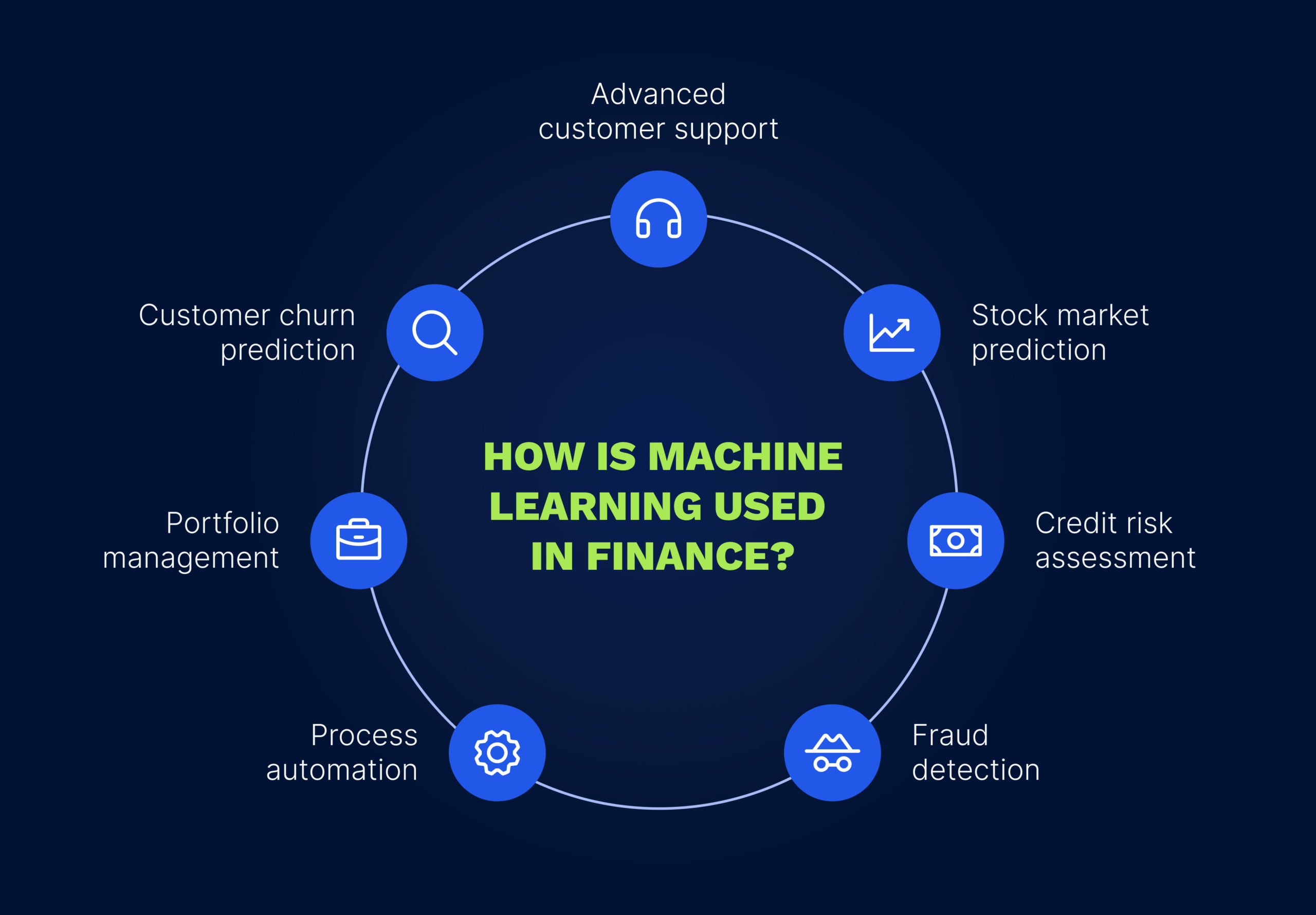

Applications of Machine Learning in Finance

Predictive Analytics

One of the most potent applications of machine learning in finance is predictive analytics. By analyzing historical data, financial institutions can forecast market trends, customer behavior, and potential risks. For example, banks can use predictive models to estimate loan default probabilities by considering various factors such as income, credit history, and spending patterns. This proactive approach empowers organizations to make data-driven decisions, ultimately optimizing their strategies.

Fraud Detection

Fraud detection has also seen a significant boost through machine learning. Financial institutions are deploying sophisticated algorithms to identify anomalies in transaction patterns, making it easier to flag potentially fraudulent activities. For instance, if a customer’s card is suddenly used in a different country within a short timeframe, machine learning models can swiftly analyze the situation and alert the customer or freeze the account.

- Real-Time Monitoring: Machine learning can process transactions in real-time, significantly reducing the time taken to detect fraud.

- Adaptive Learning: As fraudsters evolve their tactics, machine learning systems can adjust and learn from new data, maintaining effectiveness over time.

Algorithmic Trading

In the world of investment, algorithmic trading powered by machine learning is changing the game. By examining vast datasets from different market indicators, these systems can execute trades at lightning speed based on pre-set strategies and conditions. For instance, a hedge fund might employ machine learning algorithms to make split-second decisions based on the latest news, social media sentiment, or even economic reports.

Customer Service and Personalization

Finally, machine learning is redefining customer service in finance. Through chatbots and virtual assistants, financial institutions provide round-the-clock assistance. These AI-driven tools can quickly answer queries, guide users through basic tasks, and even offer personalized product recommendations based on customer preferences. Picture a scenario where you receive tailored investment advice based on your spending habits and financial goals, all thanks to machine learning’s ability to analyze customer data.

Overall, the applications of machine learning in finance provide a comprehensive suite of solutions, enhancing efficiencies, improving customer relations, and fortifying risk management practices. As we explore its benefits and challenges, it’s clear that this technology is here to stay.

Benefits and Challenges of Implementing Machine Learning in Finance

Enhanced Decision Making

As machine learning continues to permeate the financial landscape, organizations are reaping significant benefits, particularly in enhanced decision-making processes. With the power to analyze vast quantities of data quickly and accurately, financial institutions can make more informed choices. Imagine a fund manager using machine learning to sift through years of market data and discover hidden correlations that influence stock prices. This level of insight allows businesses to act with greater confidence, ultimately leading to better investment strategies and outcomes.

Risk Management Improvement

Another critical benefit lies in improved risk management. Machine learning algorithms can provide real-time analysis of risk factors by evaluating changing market conditions and customer behaviors. For example, credit scoring models can become more robust by incorporating a wider range of data, leading to more accurate assessments of loan applicants. By identifying potential risks early on, firms can implement mitigation strategies, reducing overall exposure to financial downturns.

- Predictive Analytics: Anticipating market volatility.

- Real-Time Adjustments: Adapt strategies based on immediate data insights.

Data Privacy and Security Concerns

However, the journey of integrating machine learning isn’t devoid of challenges. One of the most pressing issues is data privacy and security. As organizations collect and analyze immense volumes of sensitive customer information, they must ensure compliance with regulations like GDPR. For instance, a financial firm faced with a data breach risks not only financial loss but also severe reputational damage.

In summary, while the advantages of machine learning can significantly elevate the finance sector, navigating the challenges related to data security and privacy will be vital for sustainable success. As we continue exploring this transformative technology, it’s important to weigh these aspects carefully.

Case Studies in Machine Learning Transformation in Finance

Predicting Market Trends

As financial institutions adopt innovative technologies, case studies highlight the transformative impact of machine learning in predicting market trends. One notable example comes from a leading investment firm that leveraged machine learning algorithms to analyze historical stock data alongside real-time news articles and social media sentiment. By identifying patterns in how past events affected stock prices, the firm successfully predicted market movements with greater accuracy than traditional methods.

- Outcome: This enabled the firm to capitalize on emerging markets much quicker, leading to improved portfolio performance and higher returns.

- Key Takeaway: Incorporating diverse data sources improves not just predictions, but also strategic planning.

Credit Scoring Automation

Another compelling case study involves a fintech startup that implemented machine learning for credit scoring automation. Traditionally, lenders relied heavily on credit histories, which could overlook capable borrowers. By integrating non-traditional data points—such as utility bills, rental payments, and even social media behavior—the startup created a more holistic scoring model.

- Result: This approach significantly increased approval rates among underserved populations while maintaining acceptable risk levels.

- Advantages: The startup could process applications faster and more equitably, enhancing customer satisfaction and fostering financial inclusion.

These case studies illustrate not only the practical applications of machine learning but also its potential to shape a more adaptive and responsive financial landscape. As we delve deeper into future trends, it’s clear that the integration of such innovative solutions will continue to revolutionize the industry.

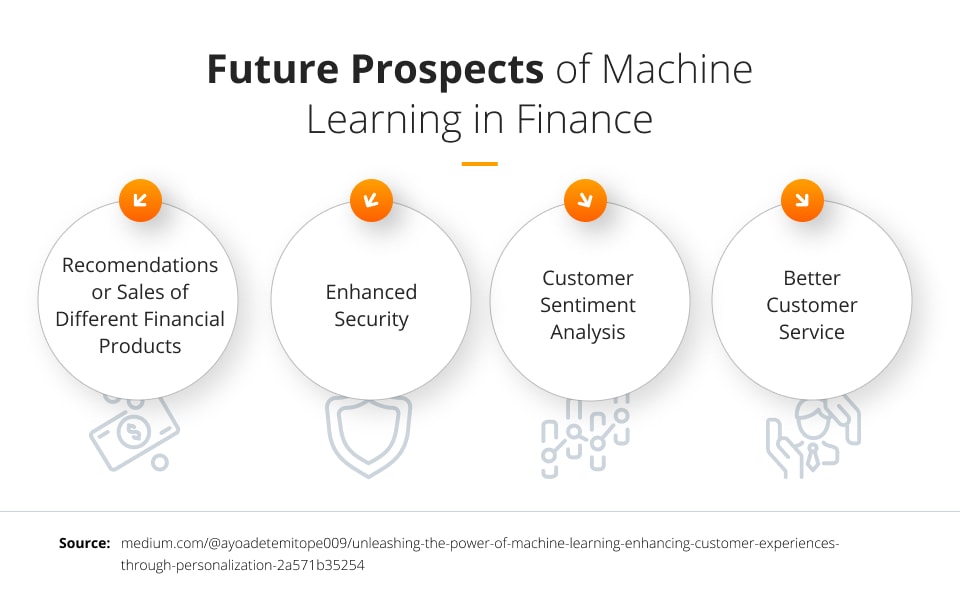

Future Trends and Innovations in Machine Learning for Finance

Increased Automation and Efficiency

As we look ahead, one of the most significant trends in machine learning for finance is the continued increase in automation and efficiency. Financial institutions are keen on streamlining operations to save time and resources. For instance, automated trading systems fueled by machine learning algorithms can now execute complex trades based on predefined criteria without human intervention. This not only speeds up trading operations but also opens up the possibility of 24/7 market engagement.

- Benefits:

- Reduced operational costs

- Faster decision-making processes

- Minimized human error, enhancing overall accuracy

An interesting case to consider involves a major bank that developed a full-scale machine learning platform to automate routine transactions and customer inquiries. The result? A significant reduction in wait times and an increase in overall customer satisfaction.

Integration with Blockchain Technology

Another emerging trend is the integration of machine learning with blockchain technology. This combination promises to enhance data security, transparency, and trust in financial transactions. For example, machine learning can analyze transaction patterns on a blockchain to quickly identify anomalies or potential fraud, providing an additional layer of security.

- Potential Applications:

- Improved fraud detection in real-time transactions

- Enhanced compliance by monitoring and verifying data on the blockchain

As these technologies evolve, the synergy between machine learning and blockchain will likely propel the finance sector into a new era of innovation. The future holds transformative possibilities, reshaping how financial institutions operate and serve their clients. With these advancements, the industry can look forward to a landscape that is not just smarter but also more secure and efficient.

Ethical Implications of Machine Learning in Finance

Bias and Fairness in Algorithms

As the financial sector continues to embrace machine learning, it is essential to address the ethical implications associated with its use. One major concern is bias and fairness in algorithms. Often, machine learning models are trained on historical data, which may contain inherent biases that can lead to discriminatory outcomes. For example, if a lending algorithm is trained on past loan approval data that reflects biased practices, it might unfairly disadvantage certain demographic groups, perpetuating inequities.

- Key Considerations:

- Regular audits of data and algorithms to uncover bias

- Implementing fairness constraints to ensure balanced outcomes

- Incorporating diverse datasets to improve model accuracy

Many organizations are now actively developing strategies to combat bias, striving for fairer and more inclusive outcomes.

Regulatory Compliance and Transparency

Another important aspect of machine learning in finance is regulatory compliance and transparency. As financial regulations evolve, organizations must ensure their machine learning models not only comply with these regulations but also maintain transparency in their decision-making processes. This is particularly crucial in areas like credit scoring and risk assessments, where customers deserve to understand how their information is used.

- Regulatory Focus Areas:

- Adherence to data protection laws (like GDPR)

- Clear documentation of model governance and processes

- Establishing accountability mechanisms for model outcomes

By prioritizing these ethical considerations, financial institutions can foster trust among customers and regulators alike. It’s evident that striking a balance between innovation and ethical responsibility will be vital as machine learning continues to shape the future of finance. Ultimately, creating a fair and transparent environment will not only enhance public confidence but also lead to sustainable growth for financial institutions.

Conclusion

Recap of Key Points

In this exploration of how machine learning is revolutionizing the finance sector, we’ve covered an impressive array of applications and implications. From predictive analytics that help institutions forecast market trends to the automation of credit scoring processes, machine learning stands as a powerful tool for enhancing efficiency and decision-making. Furthermore, we discussed the ethical considerations surrounding bias, fairness, and the need for regulatory compliance, emphasizing that responsible implementation is crucial.

Key points to remember include:

- Diverse Applications: Predictive analytics, fraud detection, and algorithmic trading are transforming traditional practices.

- Benefits vs. Challenges: Enhanced decision-making and risk management must be balanced against data privacy concerns.

- Ethical Considerations: Addressing bias and ensuring transparency in algorithms will be vital for sustaining trust.

Future Outlook for Machine Learning in Finance

Looking ahead, the future for machine learning in finance is bright. We can expect increased automation and integration with emerging technologies, such as blockchain, which will further refine data security and operational efficiency. Financial institutions are likely to invest heavily in technology while maintaining a focus on ethical practices.

- Anticipated Innovations: Ongoing advancements in natural language processing and data analysis will enable even smarter, more responsive systems.

- Societal Impact: The potential for machine learning to democratize access to finance, particularly through personalized services, is immense.

In summary, by embracing machine learning judiciously, the finance sector can not only create better experiences for customers but also promote a more inclusive and resilient financial landscape. As we navigate this evolution, it’s clear that the journey has only just begun.