Overview of Cryptocurrency Regulations

Definition of Cryptocurrency Regulations

Cryptocurrency regulations encompass the legal frameworks and guidelines set forth by governments and regulatory bodies to govern the use, trading, and creation of cryptocurrencies like Bitcoin and Ethereum. These regulations aim to create a safer environment for users while mitigating risks associated with financial crimes, consumer protection, and market manipulation.

Essentially, these rules serve multiple purposes, including:

- Preventing Fraud: Ensuring that users are protected from scams.

- Tax Compliance: Establishing taxation standards for individuals and businesses dealing in cryptocurrencies.

- Market Integrity: Maintaining a fair trading environment by preventing insider trading and other deceptive practices.

Regulations vary considerably from one jurisdiction to another, influencing the global cryptocurrency landscape.

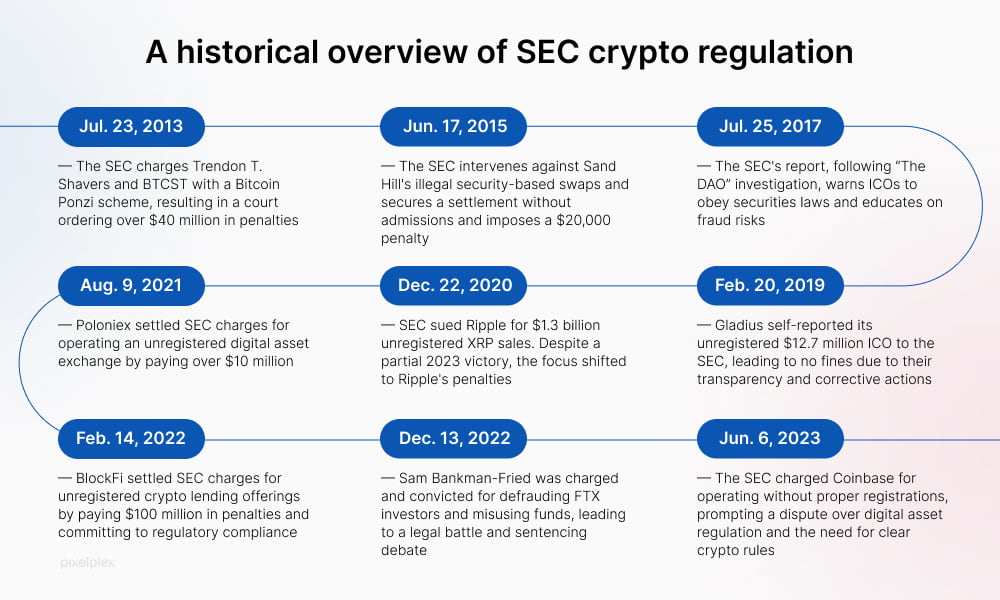

Evolution of Cryptocurrency Regulations

The landscape of cryptocurrency regulations has evolved dramatically since Bitcoin’s emergence in 2009. Initially, the focus was on understanding this new digital asset and its implications for traditional financial systems. Governments and regulatory authorities were hesitant, often labeling cryptocurrencies as “wild west” digital currencies.

Over the years, several notable developments have occurred:

- 2013-2015: The first regulatory frameworks started taking shape, primarily targeting exchanges.

- 2016-2018: Many countries began to enforce Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

- 2019-Present: There is a growing push for comprehensive regulations to integrate cryptocurrencies into the mainstream financial sector.

This evolution reflects a keen move from skepticism to establishment, highlighting an ongoing balancing act between innovation and regulation—a critical theme discussed extensively on our blog TECHFACK. As the cryptocurrency market continues to mature, so too will the regulatory frameworks that govern it.

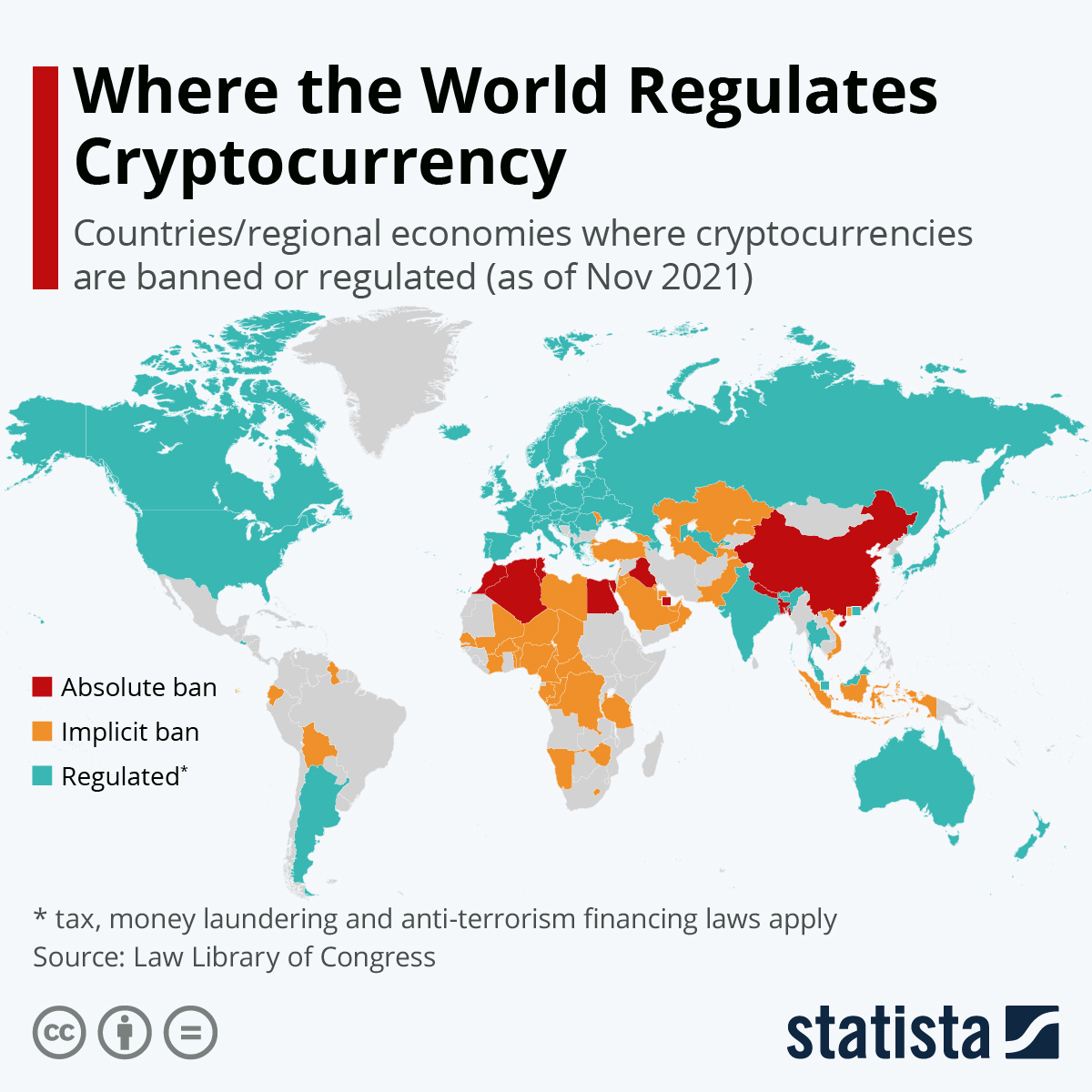

Global Landscape of Cryptocurrency Regulations

In exploring the complexities of cryptocurrency regulations, it’s fascinating to see how various regions respond to this rapidly evolving landscape. As we look around the globe, distinct regulatory approaches emerge, each reflecting the unique economic, cultural, and technological contexts of the respective regions.

Cryptocurrency Regulations in North America

In North America, the United States leads the regulatory charge, with agencies like the SEC and CFTC defining the rules of engagement.

- Key Points:

- The U.S. treats cryptocurrencies as commodities, governed by strict securities regulations.

- Canada is more progressive, allowing crypto transactions under a clear licensing framework for exchanges.

Cryptocurrency Regulations in Europe

Europe boasts a varying tapestry of regulations, with the European Union proposing a unified framework called MiCA (Markets in Crypto-Assets).

- Highlights:

- This aims to enhance consumer protections while promoting innovation.

- Countries like Switzerland have developed favorable conditions for crypto businesses due to their proactive regulatory stance.

Cryptocurrency Regulations in Asia

Asia’s dynamic regulatory landscape shows a mix of optimism and caution. Countries like Japan are on the forefront, having established a licensing framework for exchanges.

- In Contrast:

- China’s severe crackdown on crypto mining and trading showcases a stark regulatory approach.

Cryptocurrency Regulations in Africa

In Africa, regulations vary widely, with some nations embracing cryptocurrencies

- Prospective Nations:

- Nigeria has shown a strong interest in crypto but faces regulatory challenges, while countries like South Africa are moving towards clearer regulatory frameworks.

Cryptocurrency Regulations in Oceania

Australia stands out in Oceania, having implemented a regulatory regime for cryptocurrencies similar to traditional financial products.

- Essentials:

- Regulations emphasize KYC and AML compliance, allowing for greater consumer security.

Cryptocurrency Regulations in South America

In South America, the regulatory atmosphere is still developing, but countries like Brazil are beginning to draft measures to regulate crypto effectively.

- Emerging Trends:

- A significant focus on AML regulations while allowing broader access for crypto adoption.

As we can see, the global landscape of cryptocurrency regulations is always in flux. Understanding these differences can help users navigate the complexities of investing and using cryptocurrencies across various jurisdictions. Each region’s distinct approach adds to the rich tapestry of the global cryptocurrency narrative, making it an exciting time to engage with this emerging market.

Key Regulatory Issues in Cryptocurrency

Having discussed the global landscape of cryptocurrency regulations, it’s now essential to delve into the key regulatory issues that significantly impact the industry. These issues not only shape user experiences but also influence how businesses operate within the crypto space.

AML (Anti-Money Laundering) Regulations

Anti-Money Laundering (AML) regulations are critical in the cryptocurrency ecosystem. They aim to prevent illicit activities, ensuring that funds come from legitimate sources.

- Key Aspects:

- Many countries require cryptocurrency exchanges to implement AML procedures.

- For instance, exchanges must monitor transactions and report suspicious activity to authorities.

This helps create a safer trading environment, fostering trust among users and institutions.

KYC (Know Your Customer) Regulations

Closely tied to AML efforts are Know Your Customer (KYC) regulations. These regulations require businesses to identify and verify their customers before allowing them to trade or transact.

- Reasons Why KYC Matters:

- Helps in combating fraud and financial crimes.

- Establishes a more transparent trading environment.

It’s similar to when someone opens a bank account; KYC ensures that the institution knows who its customers are.

Taxation Policies on Cryptocurrencies

Taxation is another crucial regulatory issue that affects investors and businesses alike.

- Considerations:

- Countries vary in their approaches; for example, the U.S. considers cryptocurrencies as property for tax purposes.

- This means capital gains taxes apply to any profits made from trading.

Understanding the tax implications in one’s country helps avoid future headaches and ensures compliance.

Licensing and Compliance Requirements

Finally, licensing and compliance requirements are fundamental for operating within the crypto world.

- Essentials:

- Most jurisdictions require crypto exchanges to obtain licenses to operate.

- Compliance with local regulations such as AML and KYC is often a prerequisite for obtaining these licenses.

This licensing ensures that only reputable and compliant businesses can operate, thus safeguarding consumers.

In summary, these key regulatory issues—AML, KYC, taxation, and licensing—play a pivotal role in shaping the future of cryptocurrencies. They ensure a balance between fostering innovation and protecting consumers, paving the way for a more structured and secure crypto marketplace. As the crypto landscape continues to evolve, keeping informed about these regulatory challenges will be vital for anyone participating in this dynamic space.

Impact of Regulations on the Cryptocurrency Market

Building on the key regulatory issues previously discussed, it’s important to examine the broader impact that these regulations have on the cryptocurrency market. From market volatility to investor confidence and implications for innovation, regulation plays a significant role.

Effects on Market Volatility

Regulation can either stabilize or contribute to volatility in the cryptocurrency market.

- Stabilizing Effect:

- Clear regulations can provide a framework that reassures investors and reduces the wild price swings often criticized in the crypto space.

- Conversely:

- Announcements of new regulations can lead to immediate market reactions, sometimes causing sharp declines or spikes in prices.

For example, when China announced regulatory crackdowns on cryptocurrencies, many investors pulled out, leading to a significant drop in Bitcoin’s price.

Influence on Investor Confidence

Regulatory clarity can significantly bolster investor confidence.

- Positive Outcomes:

- Investors are more likely to dive into a market they perceive as regulated and secure.

- A stable regulatory environment can attract institutional investors who might be cautious about entering unregulated spaces.

A personal anecdote: Many friends in my circle, initially hesitant about investing in cryptocurrencies, began exploring options once they saw reputable exchanges operating under clear regulatory guidelines.

Implications for Innovation and Adoption

While regulations are crucial, they can also have mixed effects on innovation within the cryptocurrency industry.

- Promoting Innovation:

- Clear guidelines can encourage startups to build compliant solutions, expanding the ecosystem.

- Restricting Growth:

- Conversely, overly stringent regulations could stifle creativity and limit new ideas from emerging.

As an example, jurisdictions like Singapore have attracted crypto enterprises with their proactive regulatory approaches, fostering an environment ripe for innovation.

In conclusion, the impact of regulations on the cryptocurrency market is multifaceted. By understanding these influences—whether they stabilize markets, bolster investor confidence, or encourage innovation—investors and businesses can navigate this complex landscape more effectively. It’s a continuously evolving story, and keeping an ear to the ground is essential for staying ahead in the world of cryptocurrencies.

Future Trends and Developments in Cryptocurrency Regulations

As we look ahead, the future of cryptocurrency regulations is filled with exciting trends and developments. Understanding these changes will help investors and businesses navigate the evolving landscape more effectively, building on the insights from the previous discussions.

Regulatory Outlook for Cryptocurrencies

The regulatory outlook for cryptocurrencies appears more promising as governments worldwide recognize the importance of striking a balance between innovation and consumer protection.

- Key Trends to Watch:

- More nations are drafting comprehensive regulations to provide clarity and standardization.

- Countries with favorable regulatory environments, like Switzerland and Singapore, may lead the way in attracting crypto businesses.

For instance, the increasing dialogue between policymakers and industry leaders suggests that well-conceived regulations could foster a vibrant crypto ecosystem across different jurisdictions.

Emerging Regulatory Technologies

Emerging regulatory technologies, or RegTech, are set to revolutionize how compliance is monitored and enforced in the crypto space.

- Innovative Solutions:

- Blockchain technology can provide immutable records, enhancing transparency for regulators.

- AI and machine learning tools can analyze massive datasets to detect suspicious activities and ensure compliance.

My own experience in tech startups highlights how adopting these tools can streamline compliance, making it easier for businesses to continue innovating without falling into regulatory pitfalls.

Potential Global Regulatory Frameworks

As the world becomes increasingly interconnected, there’s a growing call for global regulatory frameworks to harmonize diverse regulations and security policies.

- Vision for the Future:

- Such frameworks could reduce confusion for businesses operating internationally, offering clearer pathways for compliance.

- Collaborative efforts by organizations like the Financial Action Task Force (FATF) may lead to standardized rules across countries.

In summary, the landscape of cryptocurrency regulation is poised for significant transformation. As regulations evolve, the focus on protecting consumers, enhancing compliance through technology, and fostering international cooperation will continue to shape the future of this dynamic market. Staying informed about these developments will enable participants in the cryptocurrency space to adapt and thrive in an intricate ecosystem that balances challenges with opportunities.