Introduction

Overview of Xero Online Accounting Software

Xero is an innovative online accounting software designed specifically for small businesses. It offers a cloud-based solution, allowing entrepreneurs to manage their finances from anywhere with an internet connection. The user-friendly interface simplifies tasks such as invoicing, bank reconciliation, and expense tracking, making it an ideal choice for those without extensive accounting knowledge. Many small business owners have reported significant improvements in their financial management after transitioning to Xero.

Benefits of Using Xero for Small Businesses

Utilizing Xero can quickly transform how small businesses manage their finances. Here are some key benefits:

- Accessibility: As a cloud-based platform, Xero is accessible on various devices, ensuring business owners can check their financial health anytime, anywhere.

- User-Friendly: The software’s intuitive design makes it easy to navigate, even for those new to accounting.

- Automation: Routine processes, such as invoicing and reporting, can be automated, reducing error and saving time.

- Collaborative Features: Multi-user access allows teams to work together effortlessly, enhancing productivity.

By embracing Xero, small businesses can streamline their operations and focus on growth.

Getting Started with Xero

Setting Up a Xero Account

Initiating your journey with Xero begins with creating an account. Simply visit the Xero website, choose your plan, and follow the prompts to enter your business details. During the setup, you’ll be asked to provide essential information, such as your business name, address, and contact details. Remember, taking a few minutes to ensure accuracy pays off later.

Navigating the Xero Dashboard

Once your account is set up, you’ll be greeted by the Xero dashboard—a centralized hub for your financial activities. The layout is intuitive, with various sections for invoices, bank accounts, and reports. A personal tip: spend some time familiarizing yourself with the dashboard layout. It makes navigating through your financials a breeze!

Connecting Bank Accounts and Integrations

To enable seamless financial management, connecting your bank accounts is crucial. Xero supports various banks, making it easy to import transactions directly. Additionally, integrations with popular tools (like payroll and eCommerce platforms) enhance functionality. Here’s a quick checklist for connecting your accounts:

- Ensure you have your bank login credentials handy.

- Follow the prompts within Xero to authorize the connection.

- Verify the imported transactions to confirm accuracy.

With these steps completed, you’re on your way to optimizing your business’s financial management with Xero.

Features of Xero

Invoicing and Billing

One of the standout aspects of Xero is its invoicing and billing feature. Users can create professional-looking invoices in seconds, customize them with their branding, and automate payment reminders. It’s a real timesaver! In my experience, implementing automated invoices made a noticeable difference in cash flow—no more late payments!

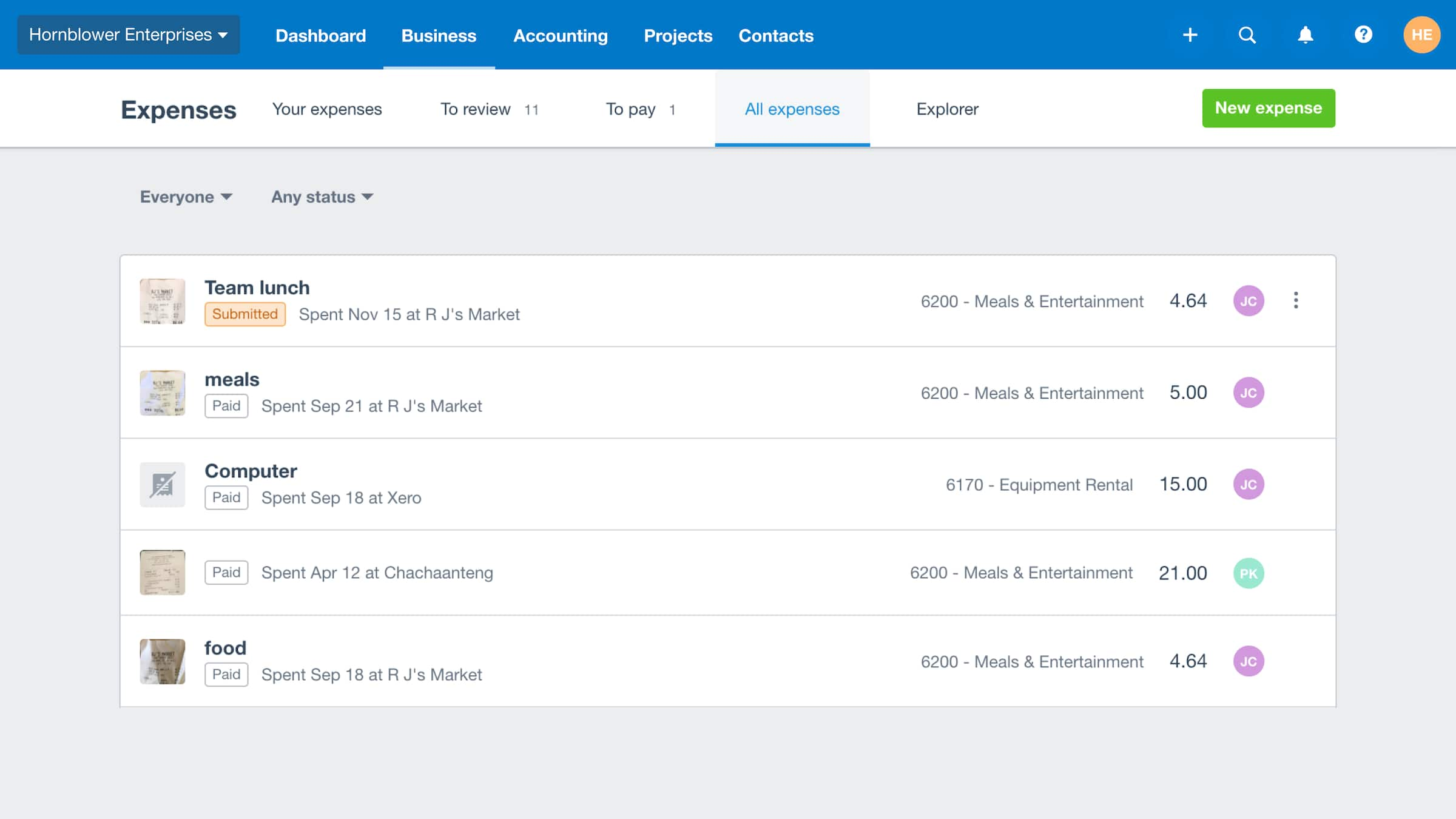

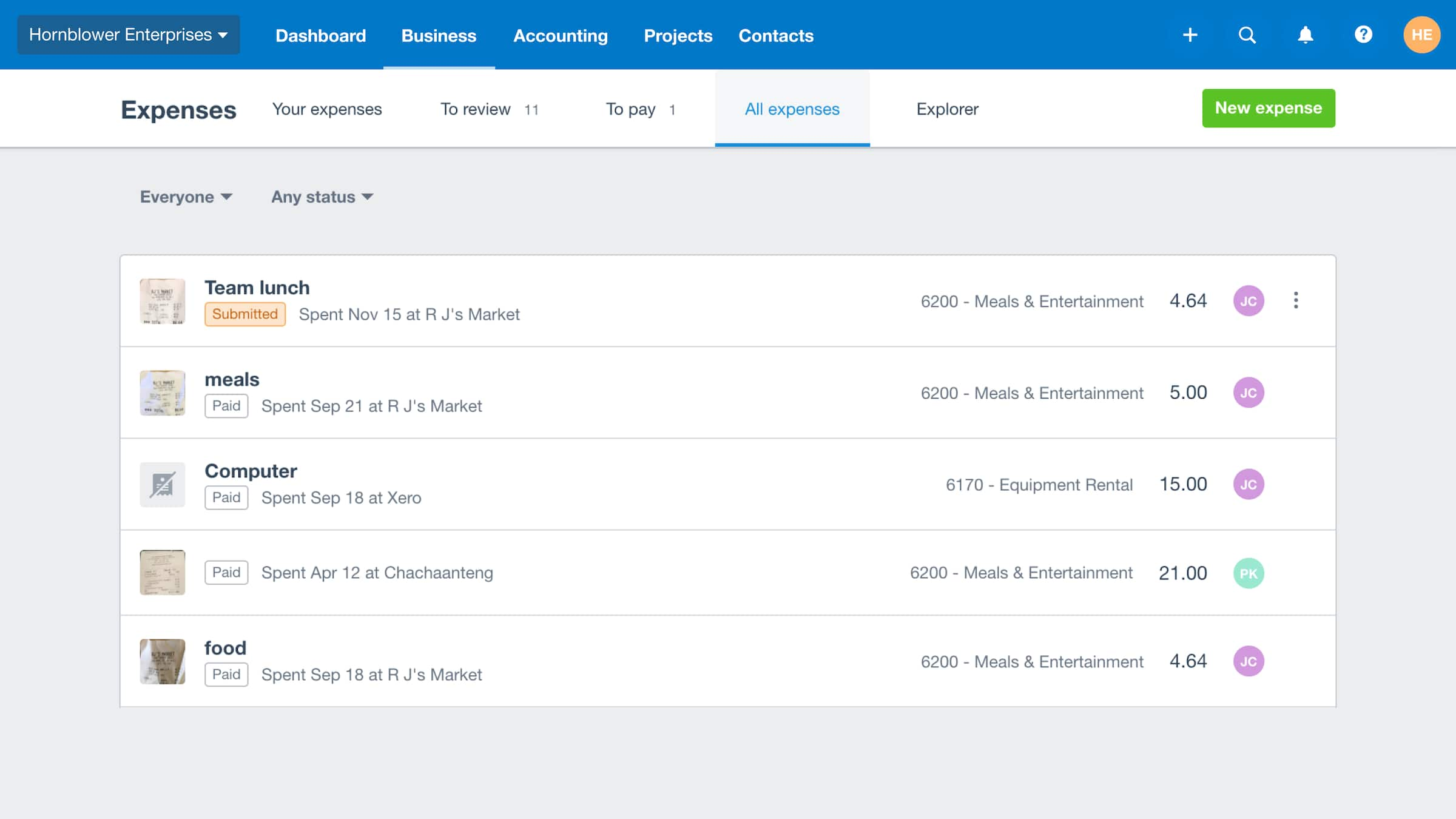

Expense Tracking

Expense tracking in Xero is a game changer. Simply snap a photo of your receipts through the mobile app, and Xero will automatically extract the details. This feature minimizes manual entry and ensures you never miss an expense. Keeping tabs on spendings became much easier, allowing business owners to make informed financial decisions.

Reporting and Analytics

Xero excels in generating insightful reports and analytics. Users can access cash flow statements, profit and loss reports, and more with just a few clicks. These tools help identify financial trends and performance, guiding strategic business decisions.

Payroll Management

For businesses with employees, Xero’s payroll management streamlines the entire process. Calculate wages, manage leave requests, and ensure compliance with tax regulations—all from one platform. The ease of use in payroll has transformed how many small businesses handle their staff payments.

Inventory Management

Finally, Xero’s inventory management feature helps track stock levels in real time. Business owners can create purchase orders, monitor stock movements, and set reorder points to avoid shortages. This capability enhances efficiency, ensuring businesses can meet customer needs without delay.

Together, these features make Xero an exceptional platform tailored for small businesses.

Xero Pricing Plans

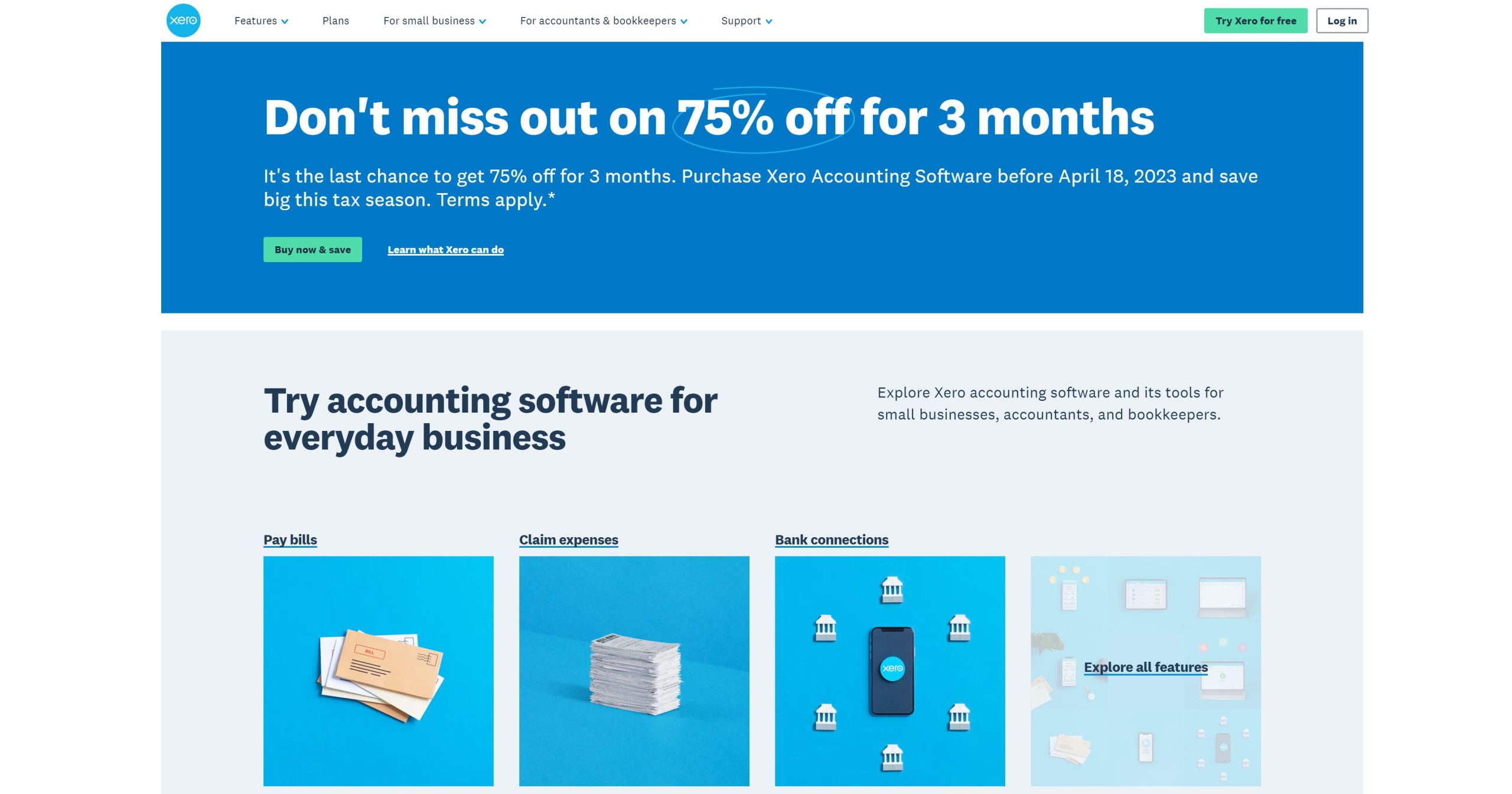

Free Trial

To help new users experience the benefits firsthand, Xero offers a generous free trial period, typically spanning 30 days. This no-obligation opportunity allows small business owners to explore features like invoicing, expense tracking, and reporting without any financial commitment. Personally, I found that this trial period gave me enough time to evaluate the software’s capabilities and determine its suitability for my business needs.

Subscription Tiers and Pricing

Once you’re ready to commit, Xero provides several subscription tiers catering to different business sizes and requirements. Here’s a quick breakdown:

- Starter Plan: Ideal for freelancers and sole traders, limited to 20 invoices and most core features.

- Standard Plan: Great for growing businesses, offering unlimited invoices, bills, and collaborative access for multiple users.

- Premium Plan: Tailored for larger entities requiring advanced features, including multi-currency support.

Comparing Features of Different Plans

When choosing a plan, it’s essential to compare features closely. For example:

- Invoicing: All plans include invoicing capabilities, but only Standard and Premium offer unlimited invoices.

- User Access: The Starter Plan limits collaboration to a single user, while the higher tiers allow more team members to participate for a streamlined workflow.

Ultimately, selecting the right plan hinges on your specific business needs and anticipated growth. Exploring these pricing options ensures that your investment in Xero aligns perfectly with your financial goals.

Customer Support and Resources

Xero Support Options

One of the key advantages of using Xero is its robust customer support system. Whether you’re facing technical issues or have questions about specific features, Xero offers multiple support channels. Users can access live chat, email support, or even the help center for troubleshooting tips. In my personal experience, utilizing live chat during a late-night invoice issue yielded a quick resolution—definitely a bonus for busy entrepreneurs!

Xero Community Forums

The Xero Community Forums serve as an invaluable resource for users to connect with one another. Here, you’ll find fellow business owners and accounting professionals discussing best practices, troubleshooting methods, and sharing tips. Engaging in these forums allows users to learn from real-life experiences. Plus, it’s a fantastic way to build your network among peers who also use Xero.

Educational Resources and Tutorials

To further empower its users, Xero provides a wealth of educational resources, including tutorials, webinars, and guides. These materials cover everything from basic accounting principles to advanced features in Xero, ensuring users can fully capitalize on its capabilities. Personally, participating in a webinar on financial reporting greatly elevated my understanding, enabling me to leverage these tools for enhanced business insights.

With these comprehensive support and resource options, Xero users can feel confident they have the assistance they need to succeed.

Integrations and Add-Ons

Third-Party Integrations with Xero

Xero’s flexibility is greatly enhanced by its ability to integrate seamlessly with various third-party applications. These integrations allow businesses to streamline operations by connecting tools they already use. For instance, linking Xero with payment processors like PayPal or Stripe can facilitate smoother invoicing and payment collection. During my own business journey, integrating Xero with my eCommerce platform saved me hours of manual data entry each month—less time on administrative tasks means more time for growth!

Popular Add-Ons for Extending Xero Functionality

In addition to third-party integrations, Xero offers a marketplace filled with popular add-ons that extend its functionality. Some notable options include:

- Receipt Bank: Automates receipt scanning and expense tracking, making expense reporting a breeze.

- Xero Projects: Perfect for project management, allowing users to track project costs and time efficiently.

- Shopify: If you run an online store, this adds eCommerce functionality directly into your accounting system.

These add-ons and integrations provide the necessary tools to customize Xero according to your specific business needs. By leveraging these resources, users can maximize efficiency and better manage their financial health.

Security and Data Privacy

Xero’s Security Measures

When it comes to online accounting, security is a top priority, and Xero excels in this area. The platform employs multiple layers of security to safeguard your financial data. Measures include bank-level encryption, two-step authentication, and regular security updates, ensuring that sensitive information remains protected. Personally, I appreciate the two-step authentication feature; it adds a critical layer of protection that gives me peace of mind as I manage my business finances.

Data Protection and Privacy Policies

Xero is also committed to transparent data protection and privacy policies. Their approach includes compliance with GDPR (General Data Protection Regulation) and other relevant laws, which is essential for businesses operating in multiple regions. Users have control over their data, including the ability to manage access permissions and retention policies.

In summary, Xero’s comprehensive security measures and commitment to data protection not only help secure your financial information but also build trust with users. This level of security is crucial for any small business owner looking to safeguard their sensitive data.

Case Studies and Success Stories

Real-Life Examples of Small Businesses Using Xero

Many small businesses have successfully integrated Xero into their operations, witnessing impressive transformations. For instance, a local café owner shared their experience of managing daily transactions and inventory through Xero. The automation of invoicing and expense tracking saved hours each week, allowing them to focus more on customer engagement and menu improvements. Similarly, a graphic design firm reported significant efficiency gains, noting that switch to Xero streamlined their billing process, making it easier to manage client projects.

Benefits and Outcomes of Implementing Xero

The benefits of implementing Xero are clear across various industries. Users often highlight:

- Time Savings: Automated processes reduce the time spent on bookkeeping tasks.

- Improved Financial Insights: Real-time reporting helps businesses make informed financial decisions.

- Cash Flow Management: Enhanced tracking of invoices and expenses supports better cash flow management.

In essence, these success stories illustrate how Xero can adapt to various business needs, drive efficiency, and ultimately contribute to a more streamlined and profitable operation. By embracing Xero, small businesses can unlock their full potential, similar to those who have already benefited from its robust features.

Conclusion and Recommendations

Recap of Xero’s Benefits for Small Businesses

In conclusion, Xero stands out as a powerful online accounting software tailored specifically for small businesses. With its user-friendly interface, robust features—including invoicing, expense tracking, and real-time reporting—it empowers entrepreneurs to manage their finances efficiently. Not only does Xero enhance productivity, but it also provides valuable insights that aid in strategic decision-making. As shared in various case studies, small business owners have experienced significant time savings and improved financial health after adopting Xero.

Tips for Maximizing the Use of Xero Software

To fully leverage Xero’s capabilities, consider the following tips:

- Utilize Training Resources: Take advantage of Xero’s tutorials and webinars to deepen your understanding of the software.

- Automate Routine Tasks: Set up recurring invoices and bank reconciliations to save time and reduce errors.

- Engage with the Community: Participate in Xero Community Forums to exchange tips and learn from fellow users.

By proactively engaging with Xero’s features and resources, small business owners can enhance their financial management and drive their business growth effectively.