Introduction

Overview of QuickBooks

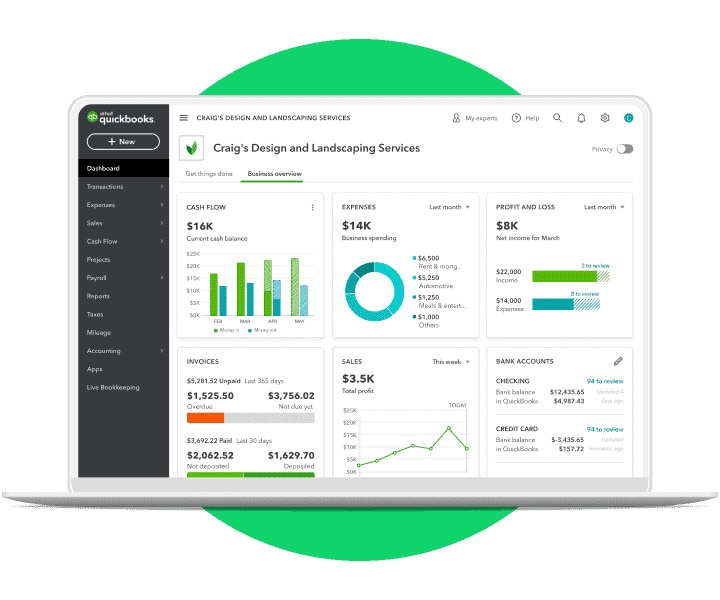

QuickBooks has carved out a significant niche in the landscape of financial management software for small businesses. This robust tool simplifies complex accounting tasks, making it easy for entrepreneurs to focus on what they do best—running their businesses. Offering an intuitive interface and a variety of features, QuickBooks allows users to manage their finances without needing a accounting degree. From invoicing to expense tracking, it’s designed to meet the diverse needs of small businesses.

Importance of Financial Management Software for Small Businesses

In today’s fast-paced business environment, having reliable financial management software like QuickBooks is not just advantageous; it’s essential. Here’s why:

- Time-Saving: Automating tasks frees up valuable time for business owners to concentrate on growth strategies.

- Accuracy: Reduces human error in calculations, ensuring that financial data is reliable.

- Better Insights: Provides real-time data analysis, enabling informed decision-making.

For instance, a small café owner who utilizes QuickBooks can effortlessly track daily sales and expenses, leading to more accurate budgeting and improved cash flow management. Thus, financial management software becomes a cornerstone in establishing a sustainable business strategy.

Benefits of QuickBooks

Streamlining Accounting Processes

One of the standout benefits of QuickBooks is its ability to streamline accounting processes. It offers a user-friendly interface that helps businesses transition from manual bookkeeping to automated systems. For example, the café owner, previously buried in paperwork, finds solace in QuickBooks’ automated invoicing features.

- Time Efficiency: Tasks that used to take hours can now be completed in minutes.

- Error Reduction: Automated calculations minimize the potential for mistakes.

Tracking Expenses and Income

Another invaluable feature is the precision in tracking expenses and income. With QuickBooks, small business owners can easily categorize transactions. This means no more guessing about what went where!

- Real-Time Monitoring: Users can view their financial health at a glance.

- Detailed Categorization: Helps identify spending patterns and areas for improvement.

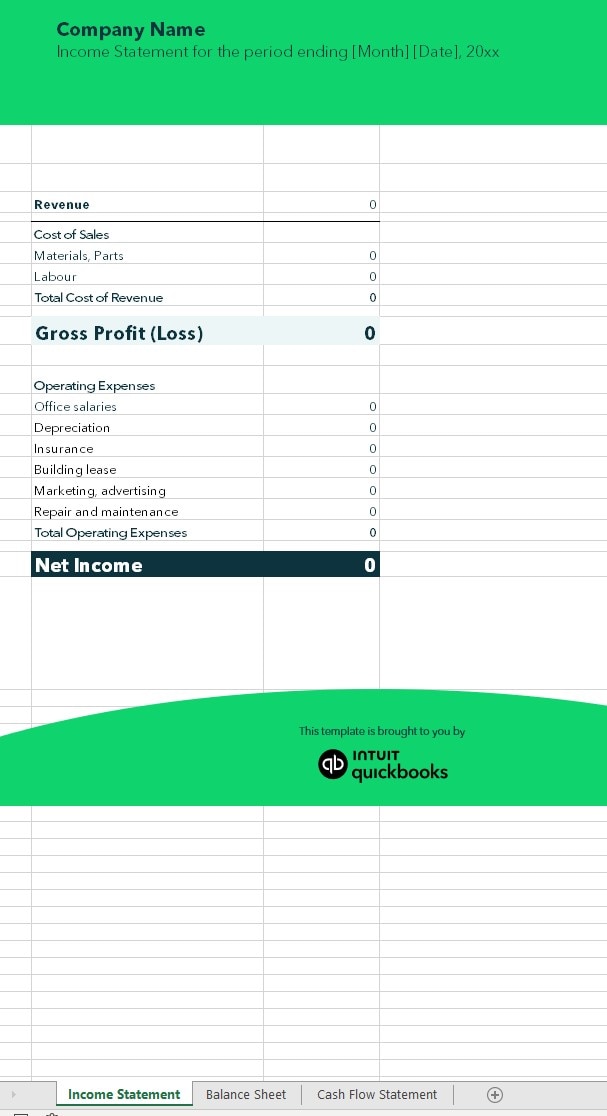

Generating Financial Reports

Financial reports are crucial for understanding business performance, and QuickBooks makes this process incredibly straightforward.

- Custom Reports: Tailor reports to focus on specific metrics that matter to your business.

- Sharing Made Easy: Quickly generate shareable summaries for stakeholders or accountants.

In a nutshell, QuickBooks transforms complex financial tasks into manageable processes, freeing up entrepreneurs to concentrate on their core business operations.

Features of QuickBooks

Invoicing and Payments

One of the most practical features of QuickBooks is its robust invoicing and payments system. Business owners can create professional-looking invoices in a matter of minutes, ensuring timely billing. For instance, a freelance graphic designer can customize invoices to showcase their brand while including payment options right on the document.

- Automated Reminders: Send reminders to clients for overdue payments.

- Payment Processing: Accept credit card payments directly through invoices.

Payroll Management

Managing payroll is often daunting for small business owners, but QuickBooks simplifies this process as well. With its integrated payroll management feature, businesses can seamlessly calculate wages, deductions, and tax withholdings.

- Direct Deposits: Employees receive their paychecks directly in their bank accounts.

- Tax Compliance: Automatic calculations help ensure compliance with tax regulations, reducing the risk of costly penalties.

Inventory Tracking

For businesses that handle physical products, inventory tracking is crucial, and QuickBooks excels in this area too.

- Real-Time Updates: Monitor stock levels in real-time without the headache of manual counts.

- Alerts for Reordering: Set notifications for when stock runs low, ensuring you never run out of essential items.

Ultimately, these features of QuickBooks not only simplify day-to-day operations but also provide peace of mind, allowing business owners to focus on growth and customer satisfaction.

Setting Up QuickBooks

Creating a Company Profile

Setting up QuickBooks starts with creating a company profile, which is your business’s digital identity within the software. This step is crucial as it lays the foundation for all your financial data. Think of it like filling out an application form!

- Basic Information: Enter your business name, address, and type of business.

- Industry Selection: Choose your industry to receive tailored suggestions and features.

Adding Bank Accounts

Next up is adding your bank accounts. This step ensures QuickBooks can automatically track your financial transactions, making bookkeeping a breeze.

- Secure Connection: Link your bank account securely for real-time updates on transactions.

- Transaction Syncing: Automatically import and categorize your transactions to save time.

Customizing Invoices and Reports

Finally, personalizing your invoices and reports is where the magic happens! Customization enhances your brand’s professionalism and ensures clarity in communications.

- Brand Logo: Upload your logo to make the invoices visually appealing.

- Tailored Reports: Configure reports to focus on specific metrics, like sales trends or expense breakdowns, making them more relevant for your needs.

In conclusion, setting up QuickBooks is straightforward and provides a solid base for managing your business finances effectively. As business owners dive into this process, they will find their operations becoming more streamlined and organized.

Using QuickBooks for Financial Analysis

Monitoring Cash Flow

Once QuickBooks is set up, users can leverage its powerful features for financial analysis, starting with cash flow monitoring. This tool allows business owners to see how money moves through their company, helping identify potential issues before they become major problems.

- Real-Time Insights: Get updated cash flow reports to see what’s coming in and going out.

- Trend Analysis: Quickly spot trends over months to understand seasonal impacts.

Budgeting and Forecasting

Budgeting and forecasting become less daunting with QuickBooks. Users can easily set financial goals and track their progress against them.

- Dynamic Budgeting Tools: Create budgets based on historical data and adjust as needed.

- Forecasting Features: Utilize data-driven projections to anticipate future revenue and expenses.

Tax Preparation

Tax season doesn’t have to be a frantic scramble, especially when using QuickBooks for tax preparation. The software organizes all financial data, making it easier to compile necessary documents.

- Tax Reports: Generate specific reports that summarize income and expenses for tax filings.

- Integration with Tax Software: Sync data directly with tax preparation tools to streamline filing.

In essence, QuickBooks transforms financial analysis into a manageable process, allowing business owners to make informed decisions, plan for the future, and stay ahead of tax requirements—all contributing to overall business health and growth.

Integrations with QuickBooks

Third-Party Apps

One of the greatest strengths of QuickBooks lies in its ability to integrate seamlessly with various third-party applications. This feature allows users to extend their software’s functionality, tailoring it to meet specific business needs.

- Enhanced Features: Integrate with tools like Shopify for ecommerce or Salesforce for customer relationship management.

- Efficiency Boost: Sync data between applications to eliminate the need for manual entries and reduce errors.

For example, a small retail store can connect QuickBooks to their inventory management system to automatically update stock levels, saving time and hassle.

Syncing with Bank Accounts

Syncing QuickBooks with bank accounts is another vital feature that streamlines financial management. This integration offers real-time insights into cash flow and transaction history, making bookkeeping easier than ever.

- Automatic Transaction Imports: Automatically download bank transactions into QuickBooks, providing up-to-date information.

- Simplified Reconciliation: Quickly match transactions and reconcile accounts, reducing the time spent on month-end closing.

By utilizing these integrations, QuickBooks users can create a comprehensive financial ecosystem that enhances productivity and minimizes errors, steering their businesses toward growth.

Troubleshooting Common Issues

Data Sync Problems

Despite QuickBooks’ many advantages, users may occasionally encounter data sync problems, especially when connecting with third-party apps or bank accounts. These issues can disrupt financial tracking, but they’re often easy to solve.

- Check Connections: Ensure that your bank account or third-party app is properly connected and authorized.

- Refresh Synchronization: Sometimes, a simple refresh of the connection can resolve temporary glitches.

For instance, a freelancer might notice discrepancies in transaction records; by re-establishing the connection, they can quickly bring everything back in line.

Software Updates

Software updates are essential for maintaining optimal performance in QuickBooks. Though updates usually enhance usability, they can sometimes lead to compatibility issues or bugs.

- Schedule Regular Updates: Set reminders to check for updates regularly.

- Backup Before Updating: Always back up your financial data before initiating an update, securing your hard work.

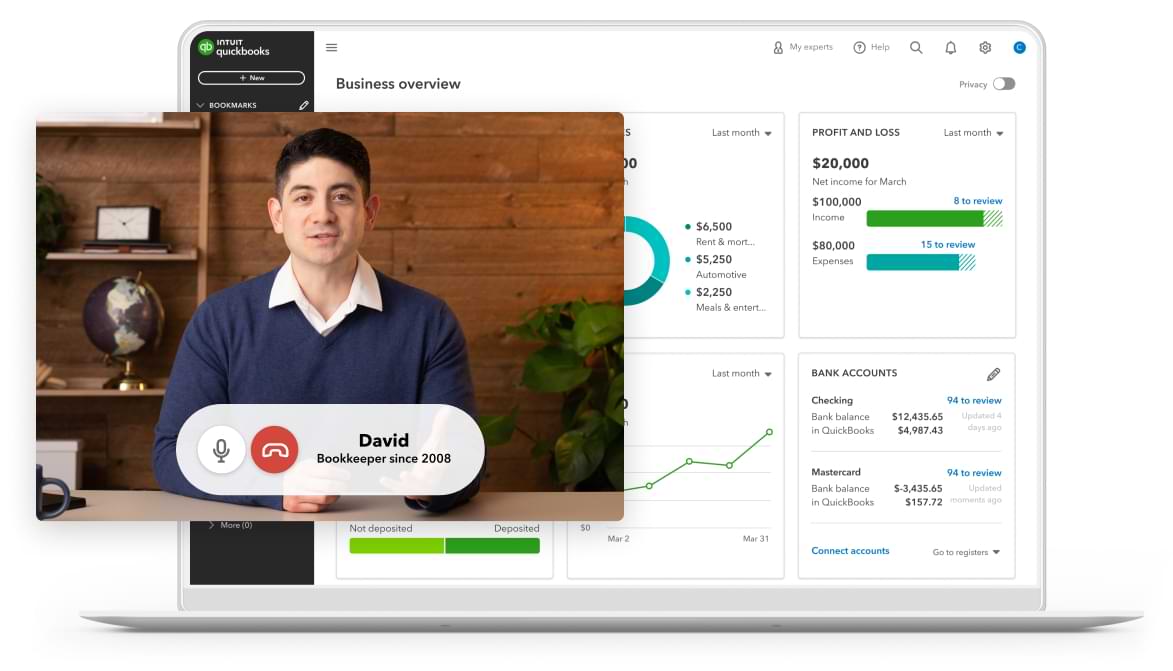

Customer Support Options

When issues persist, professional customer support can be a lifesaver. QuickBooks offers several support options to assist users in troubleshooting problems.

- Online Resources: Utilize the QuickBooks support website for articles and FAQs.

- Live Chat and Phone Support: Access quick help through live chat or by calling a support representative directly.

In conclusion, while troubleshooting may seem daunting, QuickBooks provides multiple avenues to swiftly resolve issues and keep your business operations running smoothly. Finding solutions allows entrepreneurs to focus on what really matters—growing their business.

Security and Privacy

Data Encryption

As businesses increasingly rely on digital tools like QuickBooks, security and privacy become paramount concerns. QuickBooks takes these issues seriously, employing robust data encryption methods to protect sensitive financial information.

- Bank-Level Encryption: Data is encrypted during transmission, similar to what banks use to safeguard your financial data.

- Secure Servers: QuickBooks utilizes secure server infrastructure to protect stored information from unauthorized access.

For instance, a small business owner worried about sensitive customer information can rest easy knowing that encryption ensures their data remains confidential.

Access Controls

Another vital component of security in QuickBooks is its access control features, which allow business owners to manage who can access specific information.

- User Roles and Permissions: Customize access levels for different employees based on their responsibilities. For example, a bookkeeper may have full access to financial reports, while a cashier may only need access to sales data.

- Activity Logs: Track user activity to monitor who accessed what information and when, enhancing accountability.

By leveraging these security features, QuickBooks users can create a secure environment for their financial data, thus fostering trust and peace of mind while managing their business.

Pricing Plans and Options

Subscription Models

When considering QuickBooks, understanding the pricing structure is crucial for small businesses. QuickBooks offers various subscription models tailored to different needs, ensuring that businesses can find a plan that fits their budget and requirements.

- Simple Start: Ideal for sole proprietors to manage income and expenses—usually the most affordable option.

- Essentials and Plus: These plans cater to growing businesses, including features like invoicing, bill management, and multi-user access.

For example, a small retail shop may opt for the Essentials plan to handle invoicing and payments, while a larger business might choose Plus to benefit from advanced inventory tracking.

Additional Service Costs

While the subscription covers essential features, businesses should also be aware of additional service costs.

- Payroll Services: Adding payroll functionality can incur extra fees depending on the number of employees.

- Advanced Features: Certain integrations or premium features, like advanced reporting tools, may have additional costs associated.

Overall, businesses should evaluate their needs and budget carefully when selecting a QuickBooks plan, ensuring they get the most value from this powerful financial management software. With multiple options available, finding the right fit is easier than ever!

.jpg)

Conclusion

Recap of QuickBooks Benefits for Small Businesses

In summary, QuickBooks stands out as an essential tool for small businesses aiming to enhance their financial management. From streamlining accounting processes to tracking expenses and generating detailed reports, QuickBooks equips entrepreneurs with the resources they need to thrive.

- Time Efficiency: Automation reduces the workload, allowing business owners to focus on growth.

- Real-Time Insights: Access to current financial data enhances decision-making.

- Security Features: Data encryption and access controls ensure that sensitive information is protected.

Final Recommendations

For any small business looking to simplify financial management, QuickBooks is worth considering. Here are a few final recommendations:

- Evaluate Your Needs: Assess which features are essential for your business and choose a suitable subscription model accordingly.

- Take Advantage of Integrations: Utilize third-party apps and integrations to maximize efficiency.

- Stay Informed: Regularly check for updates and new features that can improve your experience.

By embracing QuickBooks, small businesses can pave the way for more strategic financial management, making it easier to navigate the complexities of entrepreneurship with confidence.