Overview of Cryptocurrency Scams

Definition of Cryptocurrency Scams

Cryptocurrency scams are deceptive schemes designed to exploit individuals seeking to invest in or use digital currencies. These scams often promise unrealistic returns or leverage the complexities of cryptocurrency to mislead victims. Essentially, they prey on the lack of understanding many have regarding cryptographic currencies, resulting in significant financial losses.

For instance, a friend of mine once thought she found the perfect investment opportunity with a new cryptocurrency project. Unfortunately, she quickly learned that the site’s slick design and promising rhetoric were just a facade for a sophisticated scam.

Common Types of Cryptocurrency Scams

Various forms of cryptocurrency scams exist, each employing different tactics to deceive victims:

- Ponzi Schemes: These scams promise high returns with little risk, typically relying on the investments of newer participants to pay returns to earlier ones.

- Phishing Attacks: Scammers create fake websites or emails to trick users into revealing their private keys or login credentials.

- Rug Pulls: Developers abandon a project and take all investors’ funds after generating excitement and investment.

Recognizing these scams is essential for anyone looking to navigate the cryptocurrency landscape safely.

Red Flags to Watch Out For

Suspicious Investment Opportunities

When it comes to cryptocurrency, the allure of quick profits can lead many down a risky path. One major red flag is encountering investment opportunities that seem too good to be true. For example, if a project lacks transparency about its team or objectives, it’s worth proceeding with caution.

- Anonymous Teams: If you can’t find credible information about the people behind a project, it’s a potential warning sign.

- Unrealistic Technology Claims: Watch for exaggerated claims of revolutionary technologies without solid evidence or technical documentation.

Unrealistic Promises of High Returns

Another glaring red flag is the promise of high returns with little or no risk. If an investment guarantees significant profits in a short period, that’s often a scam in disguise. A colleague once invested in a scheme that promised a 300% return in a month—needless to say, he lost everything.

- Guaranteed Returns: There are no guarantees in investing, especially with something as volatile as cryptocurrency.

Pressure to Act Quickly

Scammers often create a sense of urgency to force hasty decisions. If you feel rushed to invest or sign up, take a step back. High-pressure tactics can make people act against their better judgment.

- Limited Time Offers: Be wary of schemes that try to entice you with “limited time offers.”

Recognizing these red flags can save you from potentially devastating financial loss.

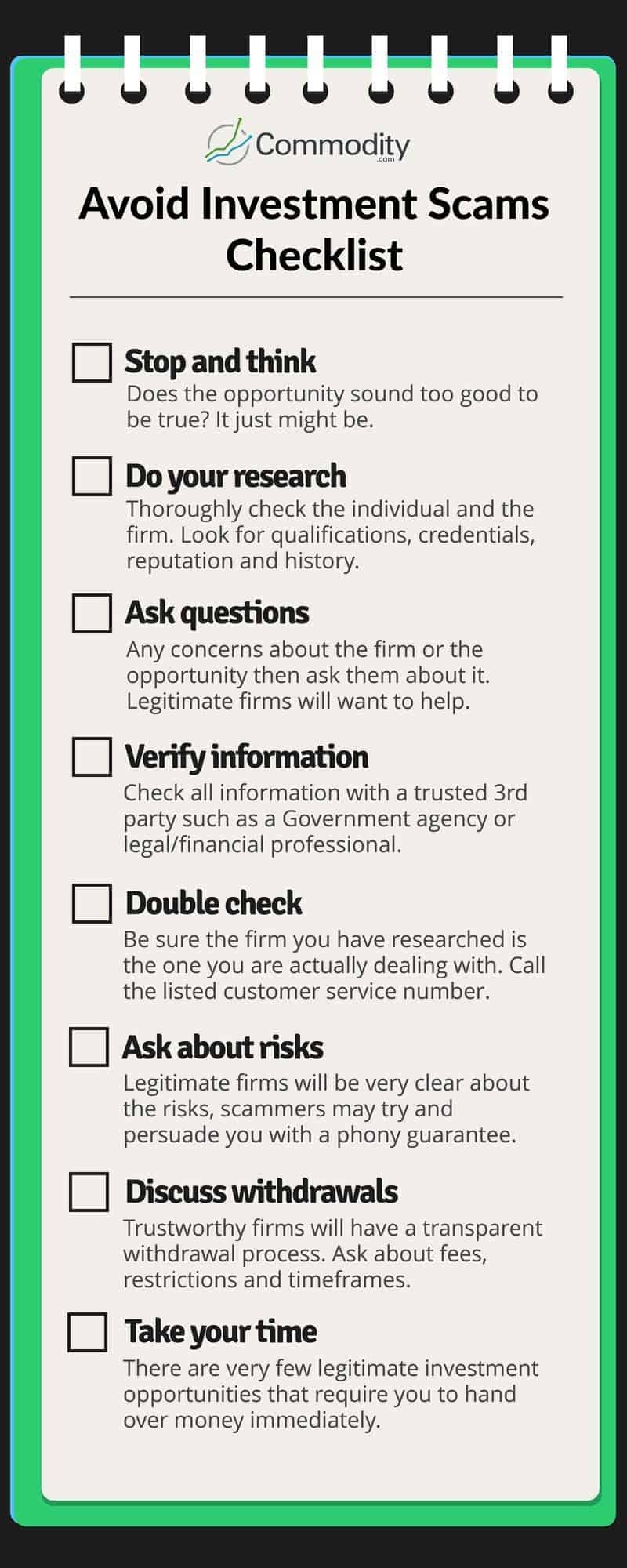

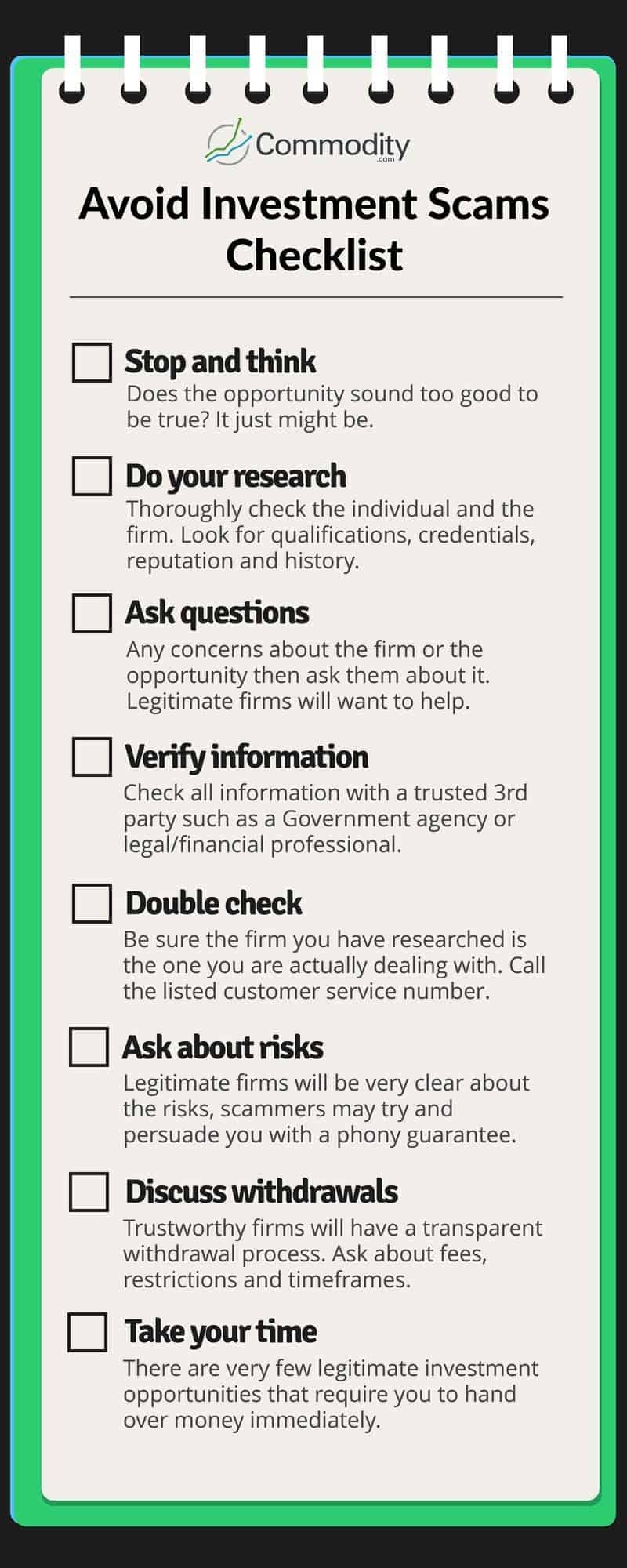

Tips for Avoiding Cryptocurrency Scams

Research and Due Diligence

The first line of defense against cryptocurrency scams is thorough research. Before investing in any project, take the time to dig deep into its background. A good practice is to:

- Verify Team Credentials: Look for information about the team members and their previous experience in the crypto space.

- Read Whitepapers: A legitimate project should have a well-written whitepaper outlining its goals and technology.

Last year, a friend of mine saved herself a significant loss by discovering inconsistencies in a project’s whitepaper—something that might have gone unnoticed with a hasty glance.

Use of Secure Wallets and Exchanges

To protect your funds, always use reputable wallets and exchanges. Some best practices include:

- Two-Factor Authentication (2FA): Activate 2FA on your accounts to add an extra layer of security.

- Hardware Wallets: Consider using hardware wallets for long-term storage to keep your assets off the internet.

Being Cautious of Phishing Attempts

Phishing attempts are on the rise in the cryptocurrency world. Always double-check URLs and email addresses before clicking any links. For example, my brother once clicked a fraudulent link that appeared to be a legitimate exchange. Luckily, he caught it just in time and didn’t lose any funds.

Being vigilant can greatly reduce your risk of falling victim to scams—stay informed and proactive!

Regulatory Measures and Authorities

Role of Regulatory Bodies in Preventing Scams

Regulatory bodies play a crucial role in safeguarding investors and maintaining integrity within the cryptocurrency market. They help create a framework that deters scams through regulations and guidelines. For example, organizations like the SEC (Securities and Exchange Commission) in the U.S. have implemented rules that require cryptocurrency projects to register and provide transparent information.

- Issuing Warnings: Regulatory authorities often issue warnings about fraudulent schemes, helping to raise public awareness.

- Licensing Exchanges: By licensing exchanges that meet specific standards, these bodies ensure that only legitimate platforms operate in the market.

A friend of mine made sure to check if an exchange was recognized by regulatory authorities before investing, which saved him from a potential scam.

Reporting Scams to Authorities

If you encounter a scam, it’s paramount to report it to the relevant authorities. Reporting scams can help prevent others from falling victim.

- File a Complaint: Whether with local law enforcement or through an online platform like the FTC (Federal Trade Commission), make sure to document the scam details.

- Share Information: Engaging with community forums can also aid in spreading awareness of fraudulent activities.

By taking these steps, victims not only protect themselves but also contribute to a safer cryptocurrency ecosystem for everyone.

Case Studies of Notorious Cryptocurrency Scams

Mt. Gox Hack

One of the most significant scandals in cryptocurrency history is the Mt. Gox hack. In 2014, Mt. Gox, then the world’s largest Bitcoin exchange, was compromised, resulting in the loss of approximately 850,000 Bitcoins, which at the time was worth almost $450 million. Users woke up to find their funds gone, and panic spread through the community like wildfire.

- Vulnerability Exploited: The hackers manipulated weaknesses in the exchange’s security protocols to access user accounts.

- Impact on Market: The hack led to a significant decline in Bitcoin’s price and raised questions about the security of cryptocurrency exchanges overall.

A friend who had been trading on Mt. Gox recounted the devastation he felt when the news broke, as he had significant funds tied up in the exchange.

OneCoin Ponzi Scheme

Another infamous scam is the OneCoin Ponzi scheme. Founded by Ruja Ignatova in 2014, OneCoin promised investors massive returns through its allegedly revolutionary cryptocurrency. However, it turned out to be a multi-level marketing (MLM) scheme designed to enrich its founders at the expense of unsuspecting investors.

- No Actual Blockchain: OneCoin lacked a real blockchain, and its tokens weren’t tradable on any legitimate platforms.

- Global Reach: Estimated losses run into billions of dollars, affecting thousands of investors worldwide.

Many individuals were lured by flashy marketing and false promises, leaving them with nothing but losses—a stark reminder of the dangers lurking in the crypto space.

Educating Others and Spreading Awareness

Importance of Educating Family and Friends

As the cryptocurrency landscape continues to evolve, educating family and friends about its potential pitfalls is vital. Many people, driven by FOMO (fear of missing out), jump into crypto without understanding the risks involved.

- Share Personal Experiences: By sharing stories about scams—like those I’ve encountered—it may help them realize the importance of due diligence.

- Encourage Questions: Create an open environment where your loved ones can ask questions without feeling embarrassed about their knowledge gaps.

For instance, when I educated my cousin about common scams, she was able to identify a fraudulent investment opportunity just in time.

Sharing Information in Cryptocurrency Communities

Engaging with cryptocurrency communities is another excellent way to spread awareness. Online forums, social media groups, and local meetups are rich sources of information where individuals share their experiences and warnings about scams.

- Participate in Discussions: Actively contribute to conversations about safe practices and recent scams.

- Resource Sharing: Share articles and resources that highlight safety measures, ensuring everyone in your network stays informed.

By fostering education and communication, we can create a safer environment for all cryptocurrency enthusiasts and protect each other from potential scams.